Krispy Kreme (DNUT) got a nice 2% boost Tuesday morning, adding to its trajectory over the past week. The stock is now up nearly 7% in that timeframe. This comes off the heels of an analyst upgrade ahead of the highly anticipated McDonald’s partnership rolling out.

The upgrade comes from Truist Securities, which moved its recommendation from buy to hold while raising the price target from $13 to $15. The stock currently sits at just $11.54/share.

But, Truist is confident that the stock is undervalued right now, especially given the company’s pending partnership and excitement around the latest earnings performance reported last month.

Krispy Kreme delivered its best quarter of sales in the company’s nearly 90-year history. Much of this was attributed to new flavors for special events, such as its Solar Eclipse and Valentine’s Day treats.

Speaking of new flavors, the doughnut maker is going all in on testing new flavors with 4 exciting additions to the menu coming soon. These permanent additions are powdered, sprinkled, cinnamon, and cookie crumb.

While there has been speculation that surging interest in weight loss drugs like Ozempic could pose a threat to the company’s sales, Truist Securities spoke to this and said there is nothing to be concerned about. The potential impact of GLP-1 drugs is baked into the price target.

It will still be a few years before the rollout of the McDonald’s partnership is complete, but Truist also sees the deal improving the doughnut maker’s legacy business in the meantime as hype continues to mount.

We were among the first to break the McDonald’s news back in March, which initially sent shares soaring more than 30%. At the time, DNUT was rated a BUY in the VectorVest system – but has anything changed since then? After taking an updated look at this opportunity in the VectorVest stocks software, we see a dramatic shift that you need to be aware of.

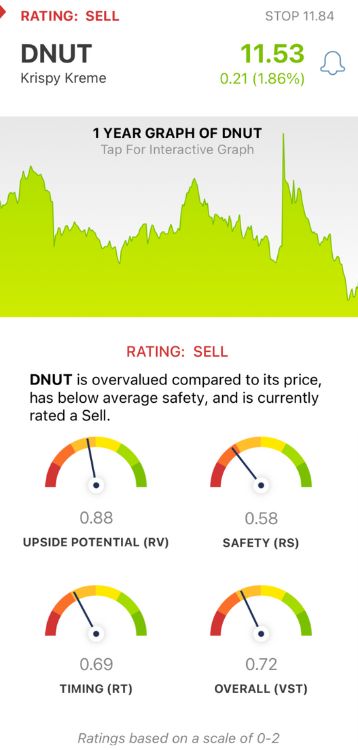

DNUT Has Fair Upside Potential But Poor Safety and Timing Holding it Back

VectorVest is a proprietary stock rating system that simplifies your trading strategy by taking complex data and transforming it into actionable insights to save you time and stress.

You’re given everything you need to know in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

Better yet, you’re presented with a clear buy, sell, or hold recommendation for any given stock at any given time based on the overall VST rating. As for DNUT, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the standard comparison of price to value alone. The RV rating improved from March when we last discussed it, it’s now fair at 0.88 compared to 0.65.

- Poor Safety: The RS rating is a risk indicator that’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. DNUT has a poor RS rating of 0.58, which slipped a bit from the 0.63 RS rating we reported in March.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. This is the biggest issue right now for DNUT, as the previous RT rating was excellent at 1.63. After losing more than 10% in the past month, though, the RT rating has fallen to 0.69, which is poor.

The overall VST rating of 0.72 is poor for DNUT, and it’s time to SELL this stock according to the VectorVest system. We encourage you to take a closer look at this situation with a free stock analysis today and transform your trading strategy for the better with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DNUT is up a bit today after getting an upgrade from Truist Securities ahead of the McDonald’s partnership rollout and following an impressive Q1 performance. However, the stock has slipped since March when we last discussed it - now, it has fair upside potential with poor safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment