After starting the year strong, Palo Alto Networks (PANW) took a 25% dip yesterday after the market closed. The stock faced a sell-off after investors were warned that the company was rethinking its 2024 revenue forecast.

The company is seeing its customers tighten budgets for IT security spending, which put a wrench in its forecast to bring in $8.15 billion to $8.2 billion for the year. Now, the range is between $7.95 billion and $8 billion. The forecast for annual total billings got cut as well, down to $10.1 billion and $10.2 billion from a range of $10.7 billion to $10.8 billion.

There has been an uptick in digital security breaches, and yet, customers aren’t finding value in Palo Alto Networks’ new offerings as the company pivots its focus towards growth. CEO Nikesh Arora admitted this is an unprecedented challenge for the company on the earnings call.

Arora also noted that there is potential to tap into AI as part of the company’s product offerings, as it rolls out new products and services to support its customer’s IT stacks.

Narrowing the focus to just the current quarter, the company walked back its revenue guidance to $1.95 billion to $1.98 billion – analysts are looking for at least $2.04 billion, meaning an earnings disappointment could be on the horizon. Even the earnings forecast of $1.24 to $1.26 per share is poised to underwhelm compared to the consensus of $1.29.

While long-term investors are still pleased with the stock’s performance over the last year (up 59% even in accounting for today’s slide), there is obvious concern for PANW investors. At a time when the company is focusing on growth, revenue is tanking.

So, where does that leave you – is it time to sell PANW if you currently hold shares? We believe it may be after taking a closer look through the VectorVest stocks software. We’ve found a few things you need to see before doing anything else…

Despite Excellent Upside Potential and Very Good Safety, PANW Has Poor Timing

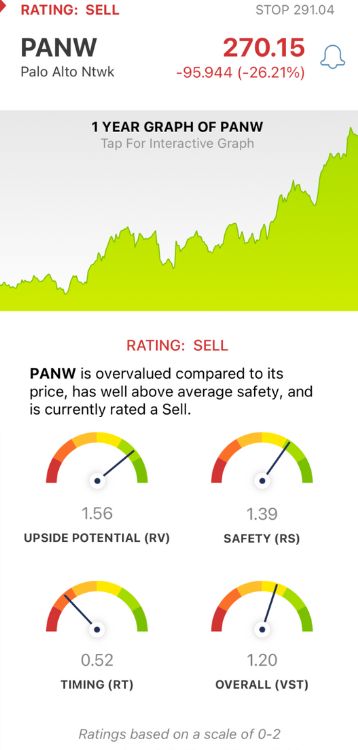

VectorVest is a proprietary stock rating system comprised of 3 simple ratings, all of which work in conjunction to save you time and stress while empowering you to win more trades. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for PANW:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. As for PANW, the RV rating of 1.56 is excellent.

- Very Good Safety: The RS rating is a risk indicator. It’s calculated from a detailed analysis consisting of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. PANW still has a very good RS rating of 1.39.

- Poor Timing: The big issue for PANW investors right now is the negative price trend that has gripped the stock, as confirmed by the poor RT rating of 0.52. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.20 is good for PANW - nevertheless, the stock is rated a SELL in the VectorVest system. Learn more about this situation by getting a free stock analysis today, transforming the way you trade for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PANW is down more than 25% after cutting its guidance on concerns of tightening customer spending. The stock still has excellent upside potential and very good safety, but its timing is poor right now, suggesting it may be time to sell.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment