Intuit (INTU) posted third-quarter results yesterday in which the company narrowly beat the analyst estimate on both the top and bottom lines. The company even raised its full-year guidance. But, the stock is down 8% as a result.

Intuit is primarily known for its array of tax assistance products – Credit Karma as a personal finance portal, QuickBooks as an accounting software for small businesses and even some individuals, and TurboTax.

The latter is what really moved the needle in this most recent quarter thanks to its AI-integrated products, which helped individual filers streamline the convoluted process of tax season.

Revenue grew by 12% to $6.74 billion, just ahead of the $6.65 billion analysts were expecting. Earnings came in at $9.88 per share compared to the consensus of $9.37 per share.

CEO Sasan Goodarzi spoke to these results saying the company is witnessing what he feels is “officially the end of the COVID-19 era”, and a return to normalcy. He called this most recent tax season the first normal cycle in years.

Goodarzi also said the company will be testing its Gen-AI-driven SKUs, which he claims people will be willing to pay more for as it does everything for you, simplifying the process of bookkeeping and taxation.

Intuit is expecting revenue between $3.06 billion and $3.10 billion for the current quarter, while the consensus estimate sits at $3.04 billion.

The company also raised its outlook for the year to between $16.16 billion and $16.20 billion. This is up from the previously issued guidance of between $15.89 billion to $16.11 billion. According to the LSEG data provided, analysts are expecting just $16.05 billion.

All things considered, you would expect the market to react positively to this news – and yet, the stock is now down 8% today. INTU had been rallying in the right direction heading into yesterday’s earnings announcement, but that trend has reversed.

So, where does that leave you as a current investor or speculative trader? We’ve got 3 powerful insights you need to see to help you make your next move with complete confidence – here’s what we found in the VectorVest stock software…

INTU Has Excellent Upside Potential and Safety, But Poor Timing is Holding the Stock Back

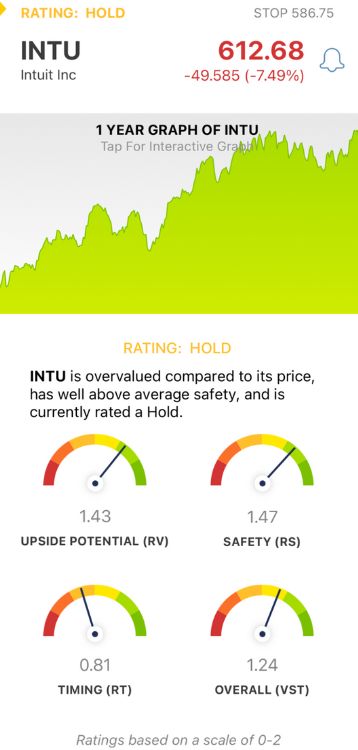

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting, all while saving investors time and stress. It’s all based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even better, though - you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for INTU:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone. Instead, it compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. INTU has an excellent RV rating of 1.42.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. INTU has an excellent RS rating of 1.47.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. It shows you the full picture of a stock’s price trend, and as you can see from INTU performance recently, it has a poor RT rating of 0.81.

The overall VST rating of 1.24 is good for INTU, but not quite enough to justify buying the stock at this time. It’s rated a HOLD in the VectorVest system.

That being said, there’s more to this story than meets the eye - which is why we highly encourage you to get a free stock analysis at VectorVest today and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. INTU delivered a solid Q3 performance coupled with upbeat guidance for the current quarter and the full year - and yet, the stock is down 8% Friday. It does have excellent upside potential and safety, but the timing is poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment