Foot Locker (FL) released company earnings Friday morning, in which the company didn’t just underperform – they expect things to get worse in the road ahead. The previous full-year guidance has been abandoned amidst a challenging economic climate. And as a result, shares are down 27% so far today.

Just how bad was it, though? Revenue was down for the first quarter, with a figure of $1.93 billion compared to $2.18 billion this time last year. This fell short of analyst expectations, which were projecting $1.99 billion.

Moreover, the company underdelivered on EPS as well at just $0.70 – a dramatic fall from this period in 2022 when Foot Locker reported EPS of $1.60. Experts had an estimate of $0.77.

This quarter is the fourth in a row where Foot Locker revenue has declined. But, this was to be expected according to CEO Mary Dillon. The company has been clear that 2023 was to be a “reset year”. With that said, it appears that they may have been a bit too conservative in their estimation of just how bad things would get.

In saying that, the company projected a decline for the year of 5.5%. But now, they’ve taken a step back and readjusted that decline to as much as 9%. If this proves accurate, it would be the first time the company has seen a more than 6% decline in over 13 years.

Now, Foot Locker isn’t alone in these woes. Other consumer brands like Target, Nike, Home Depot, and others have warned that a slowdown in discretionary spending will take a hit on annual sales targets. In fact, Under Armour told shareholders back in May that things are going to be particularly troublesome for brands in the athletic apparel industry.

This begs the question – is it time to move on from Foot Locker if you’re currently holding a position? Or, is today’s reaction going to smooth over in the days and weeks ahead? We’ve taken a look at FL through the VectorVest stock analyzing software. There are 3 things you need to see before you do anything else…

While FL Has Fair Upside Potential and Safety, the Stock Has Very Poor Timing

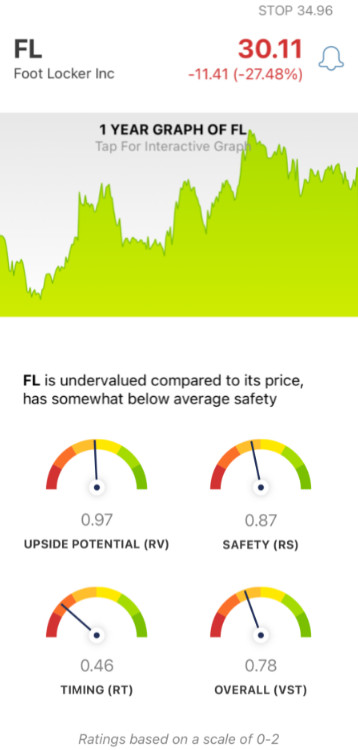

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights through three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average. Stocks above the average indicate overperformance, and vice versa. But, based on the overall VST rating for a stock, the system is able to provide investors with a buy, sell, or hold recommendation - at any given time. As for FL, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (3 years out) to AAA corporate bond rates and risk. As for FL, the RV rating of 0.97 is just below the average - and considered to be fair. And, the stock is undervalued - with a current value of $33/share

- Fair Safety: In terms of risk, FL is a fairly safe stock - despite the fact that the RS rating is a bit below the average at 0.87. This rating is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The biggest issue for FL right now is the strong negative price trend that has gripped the stock. The RT rating of 0.46 is very poor. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for FL is poor at 0.78 - does that mean it’s time to cut losses on FL stock and move on? Or is there any reason to believe things could turn around in the near term?

Don’t let emotion cloud your judgment or play the guessing game with this decision. Get a clear answer on your next move with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for FL, it still has fair upside potential and safety. But, after today’s grave earnings release, the timing is very poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment