Shares of Spotify Technology (SPOT) are up more than 6% so far in Tuesday’s trading session on the heels of delivering Q4 guidance. Despite falling short in earnings for the final quarter of 2023, the upbeat guidance for growth in active users stole the spotlight.

After finally posting a profit in Q3, Spotify took a step backward for Q4. The net loss of 70 million euros was driven primarily by severance charges after slashing its workforce last year. Real estate-related charges also played a part here.

This came out to a loss of 0.36 euros per share, wider than Wall Street was hoping for at 0.31 euros per share. However, this was a much better performance than 2022 when Spotify reported a loss of 2.23 euros a share.

That being said, there is reason to be optimistic, as profitability is beginning to move in the right direction. Gross margins of 26.7% came in just above the company’s guidance. The long-term goal is to get that figure in the 30-35% range, which will come from scaling its podcasting and ads businesses.

Revenue was a bit of a disappointment too, even though the figure of 3.67 billion euros was a 16% growth year over year. The analyst consensus called for revenue of 3.72 billion euros.

However, there was good news to come out of the fourth quarter – monthly active users soared above the estimate to 602 million, a 23% growth year over year. This growth will continue into the first quarter of the year with an expectation of 618 million users.

Experts have long questioned Spotify’s ability to turn a profit. The company’s focus on profitability has narrowed after spending over a billion in an effort to take a stranglehold on podcasting, but it hasn’t panned out yet.

Spotify responded with layoffs, price hikes, changes to royalty structuring, and other adjustments to attempt to work toward profitability.

All of this news follows the $250 million deal with Joe Rogan, announced just last week. That announcement alone sent shares surging, and they’re now up 24% through 2024 thus far. That being said, where does all this leave investors?

We’ve taken a look at SPOT through the VectorVest stock analysis software, discovering that this stock is a compelling BUY now. Here’s why…

SPOT May Have Poor Upside Potential, But Fair Safety and Excellent Timing Make it a BUY

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it, eliminating all guesswork and uncertainty from your trading strategy.

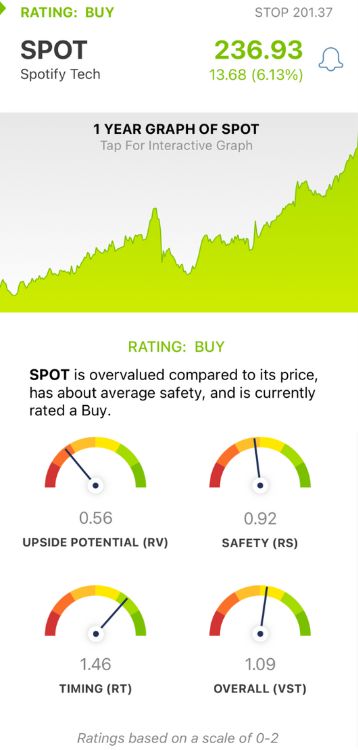

You’re given all the insights you need in 3 simpler ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even easier, though. You’re offered a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for SPOT, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It’s a much better indicator than a simple comparison of price to value alone. SPOT has a poor RV rating of 0.56 right now.

- Fair Safety: SPOT is a fairly safe stock, though, with an RS rating of 0.92, just below the average. This risk indicator is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, and other factors.

- Excellent Timing: As you can see from SPOT’s performance recently, the stock has excellent timing - and the RT rating of 1.46 reflects this. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.09 is just considered fair, but it’s enough to earn SPOT a BUY recommendation in the VectorVest system. Learn more about this opportunity with a free stock analysis today and make your next move with confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SPOT may have underwhelmed investors with Q4 earnings, but optimism on user growth was enough to send shares 6% higher today. The stock has poor upside potential, but fair safety and excellent timing are enough to earn it a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment