Yesterday, we discussed how Crispr stock enjoyed a short-lived jump ahead of seeking FDA approval for their gene therapy drug. But today, we’re here to talk about a drug company that has experienced a much larger spike as a result of positive news: Biogen.

Biogen is engaged in discovering, developing, and delivering therapies for neurological and neurodegenerative diseases. And so far, they’re up over 37% today as a result of positive findings on their Alzheimer’s drug.

Last night, they shared results from a study involving about 1,800 early-stage Alzheimer’s patients. Their drug – Lecanemab – helped slow patient decline by 27% after 18 months. Areas the study monitored include memory, judgment, problem-solving, and personal care. The company claimed in their release that this is just the start, and they have much more to share about their drug and its possibilities in late November. They’re awaiting publication in a peer-reviewed medical journal.

And, like Crispr, Biogen (along with Eisai, a co-producer of the drug) is seeking accelerated FDA approval to get the drug to market in a hurry. Only in this case, it’s likely they’ll earn it. As a result, we’re seeing Biogen stock soar – but should you buy now? After all, we’ve seen a similar scene play out with Biogen in the past – and they ended up fumbling the rollout.

Last year, Biogen released a new Alzheimer’s drug – Aduhelm – which completely flopped. It was not received well by doctors or insurance providers. Biogen was forced to cut the price of the drug multiple times in an effort to increase prescriptions, but as insurers blocked or restricted coverage, sales were dismal. However, it’s worth noting that Iecanemab is not the same drug as Aduhelm. This time, Biogen has the results to back up what they claim. Analysts and researchers alike claim this could be the most encouraging treatment to date for Alzheimer’s.

And, to help you determine whether or not this stock could be a good opportunity for you, we can take a look through the VectorVest system. This simplifies analysis and helps you tune out the noise so you can make sound, emotionless decisions.

Does Excellent Timing Outweigh Poor Upside Potential & Safety?

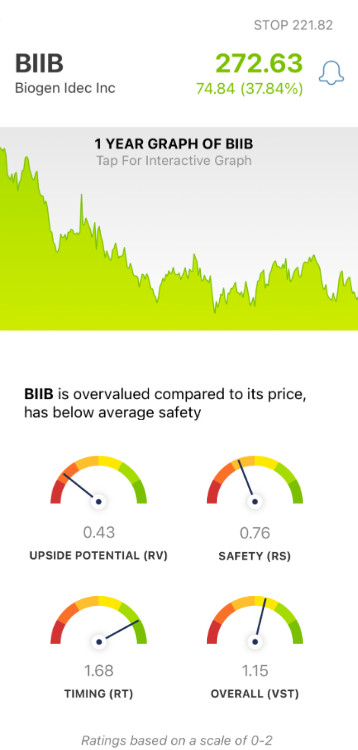

VectorVest tells you everything you need to know about a stock based on three simple ratings, all situated on a scale of 0.00-2.00. These are relative value (RV), relative safety (RS), and relative timing (RT). Together, these three ratings contribute to an overall VST rating – and from there, you gain a clear buy, sell, or hold recommendation – for any given stock, at any given time. And, here’s what the system is showing for Biogen right now:

- Very Poor Upside Potential: positive drug news aside, VectorVest calculates Biogen’s current value to be around $83 – suggesting it’s way overvalued at the current share price. And when taking a look at the long term price appreciation for the stock, the system shows a very poor RV rating of just 0.43.

- Poor Safety: the RS rating indicates risk. It’s calculated based on the consistency and predictability of a company’s financial performance, business longevity, debt-to-equity ratio, and other risk factors. As for Biogen, the RS rating of 0.76 is poor.

- Excellent Timing: VectorVest helps you gain a clear understanding of a stock’s price trend. The RT rating is based on the direction, dynamics, and magnitude of a stock’s price movement. And after the latest news on Biogen, the RT rating of 1.68 is excellent.

With all this said, the overall VST rating of 1.15 is good on a scale of 0.00-2.00. It’s hard to ignore an explosive price increase as we see in Biogen today. Just keep in mind that the fundamental analysis is weak making this a speculative trade. However, this new drug has the potential to have a massive positive impact. It’s a game changer!

Clearly, a medical breakthrough to fight Alzheimer’s will mean the world to people suffering with the disease and big dollars to the company and its investors. It is exactly the kind of product Biogen needs to turn around the Earnings trend and lead to sustained growth for the company’s stock. It’s just a matter of how much confirmation you need to be convinced this new drug, Lecanemab, is the real deal. So, should you buy it now? Or, should you wait for further validation? Discover a clear next move on Biogen by analyzing the stock free with VectorVest full stock analysis report.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for BIIB, it is overvalued with very poor upside potential and poor safety – despite the latest news. With that said, it has a strong positive price trend that will continue to push the stock’s price up higher.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment