Shares of Arm Holdings (ARM) are up just over 6% to start the week on news that the company intends to capitalize on the AI craze and begin producing its own chips as soon as 2025.

Arm is a chip designer based in Britain that licenses its designs to other companies rather than manufacturing them in-house. It is paid through a royalty model. The company’s target audience includes those who want to power new AI models through their own chips without relying on Nividia.

Now, the UK-based group has set its sights on having its own AI chip division set up with a prototype ready by spring of next year. Contract manufacturers will handle mass production starting the following fall.

Arm’s first order of business is securing production capacity. Taiwan Semiconductor Manufacturing Corp has already been named as one of the potential suitors, as negotiations are well underway.

As a subsidiary of SoftBank, Arm will have some help with the investment but will cover costs for the development, which some say could end up costing hundreds of billions of yen.

Arm just went public less than a year ago but has already benefited from the AI hype, with investors placing their bets on the company, leading to a market value in excess of $100 billion.

ARM has now climbed 12% in the past week as excitement has mounted heading into its parent company’s earnings day. However, it did struggle through April, losing more than 25% in the month.

That being said, momentum appears to be pushing the stock back in the right direction. Should you get in on the action yourself and buy ARM if you haven’t already?

We’ve taken a look at this opportunity through the VectorVest stocks software and found 3 things you need to see before you do anything else.

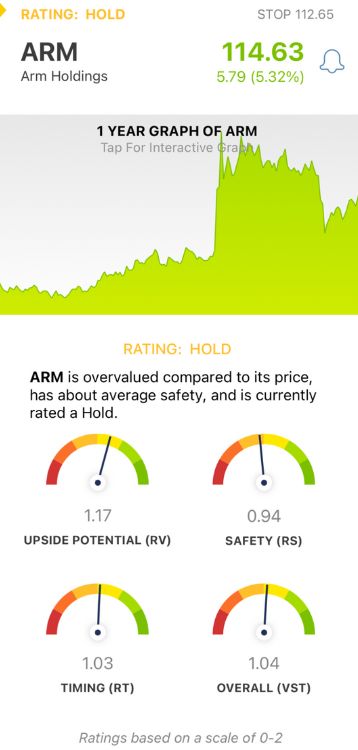

ARM Has Good Upside Potential With Fair Safety and Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It saves you time and stress by giving you all the insight you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better though, as you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for ARM, here’s what you need to know:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. ARM has a good RV rating of 1.17.

- Fair Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. ARM has a fair RS rating of 0.94, just below the average.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. ARM has a fair RT rating just above the average at 1.03.

The overall VST rating of 1.04 is fair for ARM, but the stock is currently rated a HOLD. Watch for more developments on this situation as validation of the stock’s positive price trend could change things for ARM in a hurry. Learn more about this opportunity with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ARM gained around 6% Monday morning on news of its plans to expand into the AI chip market. The stock itself has good upside potential with fair safety and timing, but it’s rated a HOLD for the time being.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment