Last week, Apple (AAPL) became the first company in history to reach a valuation of $3 trillion. This comes from investor intrigue as the tech giant expands into new markets and upcoming scheduled product releases.

But, it’s not just hype around new products. It’s the company’s impressive financial standing. In May, Apple’s quarterly earnings displayed revenue and profit that outperformed the analyst expectations. The excitement around Apple was bolstered by an intensive stock buyback program.

As global economic uncertainty continues to mount, companies like Apple will become more and more sought after due to their safe reputation. In the past 3 months, shares have climbed 17%. Just under a month ago, we talked about how this was all but inevitable as upcoming releases like the Apple Vision Pro and iPhone 15 were gaining more and more hype.

In fact, there is reason to believe that AAPL shares are far from finished. Today, they sit at $192/share. But some analysts believe they can keep climbing as high as $220/share.

That being said, is Apple going to keep going and hit that $4 trillion valuation? Or, is this the wall against which they’ll rebound? One key forecast in getting to this valuation has been the Apple Vision Pro. And just weeks after unveiling it, the company has already backtracked its revenue forecast for this product.

While many scoffed at the price tag ($3,500/unit), the challenge doesn’t appear to be demand – but supply. The company is facing challenges in production that will set them back, and potentially lead to half as many sales as originally anticipated.

All this has investors wondering if they should capture their profits over the past few months and run. Or, if there is more to come – and if staying the course is the smart move. To help you feel more clear and confident in your decision one way or the other, keep reading below – we’ve taken another look at AAPL stock through the VectorVest stock forecasting software.

AAPL’s Upside Potential, Safety, and Timing Have All Improved Since We Last Talked About the Stock

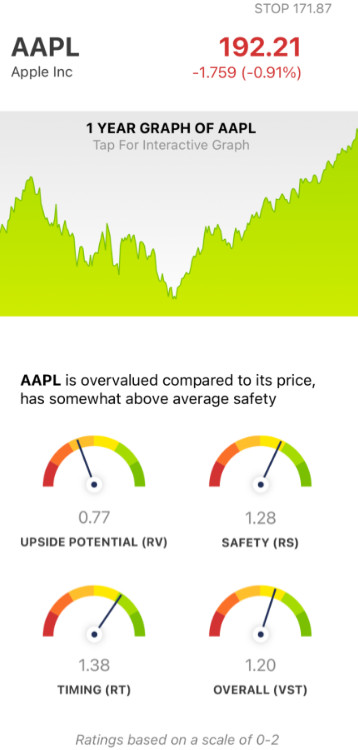

The VectorVest system helps you simplify your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy, as ratings above the average indicate overperformance and vice versa. That being said, it gets even simpler - as the system issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for AAPL, here’s an update on the stock…

- Poor Upside Potential: The RV rating of 0.77 is considered poor for AAPL, but it is a slight improvement over the past month. This rating compares the stock’s long-term price appreciation potential to AAA corporate bond rates and risk. While the stock is still overvalued - with a current value of $95 - this is a higher valuation than previously projected.

- Very Good Safety: In terms of risk, APPL has very good safety - with an RS rating of 1.28. This is, again, an improvement from last month. The rating is derived through a calculation of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: And, in terms of price trend, AAPL’s momentum has only gotten stronger - and has led to an even better RT rating of 1.38, up from 1.31 last month. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

All things considered, AAPL’s overall VST rating of 1.20 is an improvement from the 1.16 we uncovered last month. That being said, is there still room for this stock to climb higher - or should you exit now with a profit?

Only you can determine your next move based on your goals and risk tolerance. That being said, Vectorvest can help you feel more secure in your decision - get a clear buy, sell, or hold recommendation today with a free stock analysis on AAPL!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While AAPL has officially surpassed the $3 trillion valuation, there is reason to believe the stock is far from finished on this run. While it still has poor upside potential, the stock is bolstered by very good safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment