The Sticky Trends of the Stock Market – Fantastic Female Fridays with Laurie Winkless

I had the unexpected pleasure of seeing Laurie Winkless, an Irish physicist, present on stage in Wellington when I had the delightful opportunity to work with the Irish Embassy in New Zealand for St. Brigid’s Day. This is the national holiday we have in Ireland to celebrate the history and presence of Irish women led by our female patron saint St. Brigid. During her highly insightful and entertaining presentation, she took us on a whistlestop tour of female scientists through history that has made their mark on how we live today. I found this intriguing as I hadn’t come across many of the people she talked about and since then, I’ve kept a keen eye on Laurie’s Twitter account as she continues to be highly insightful and entertaining (as well as articulate) there too. It was a natural choice then, for me to invite her to be a guest on Fantastic Female Fridays. Over an 8 a.m. call in Ireland as she was about to go to bed in New Zealand, she told me about her recently published book “Sticky”, a publication all about the science of surfaces. The title for our interview came to me quickly “The Sticky Trends of the Stock Market”.

Science and the Stock Market

You might well wonder what has physics got to do with the stock market? As a trained economist, I know that every aspect of our geopolitical, social, cultural, historical, legal, environmental, etc lives eventually leads to affecting the economy, and thus, I set out to explore the connection. Little did I know that big engineering projects were the catalyst for the capital markets themselves. I found the following quote from “The Evolution of Science-Based Business: Innovating How We Innovate”, a Harvard Business School paper:

“Advances in the application of mechanical and electrical power to production (and later chemicals) made mass production technically feasible, but again, without access to capital (made possible by the development of more sophisticated capital markets) and creation of administrative structures to coordinate the diverse activities of these large scale enterprises, mass production would bot have been economically possible.

Necessity is the mother of innovation and when the Industrial Revolution brought a new slew of production processes, their potential scale was far too much for any small business to handle – both in terms of the capital needed as well as the risk of taking it on. This engineering transformation led to a financial one along with it.

What stocks do investors stick to?

In my research for this interview, I bought “Sticky” and read as much as I could before we went live. It is an intriguing perspective on the world and I talk more about that in the interview. However, one quote jumped out to me that applies to physics and the stock market equally “how well paint bonds to a surface depends just as much on what it’s sticking to as what it’s sticking with”.

As investors, we can be researching stocks, trying out different parameters on Unisearch, and backtest with Auto timer. We can look for stocks with high Relative Safety (i.e. consistency and predictability of earnings and dividends) or a high Comfort Index (i.e. a stock’s ability to withstand severe and/or lengthy price declines). We can truly make a big difference to the returns we make and the risk we take on and in analogous terms, I call this “what we’re sticking with”. It’s also important to understand the inherent volatility in the market and how it reacts to different developments whether that’s interest rate expectations, a company’s CEO making a sudden departure, or a pandemic. Following through with my analogy, this is what I refer to as “what we’re sticking to”. We can’t precisely map our projections forward based on the past, but we do need to optimize what is in our control.

Emerging trends

During the interview, I asked Laurie about emerging careers in science. I expected her to tell me about new novel titles and job descriptions. However, instead, she told me that emerging careers are likely to be borne out of “expertise and knowledge in different disciplines”. She gives the example of somebody who might be an engineer and their background is in zoology … and she follows up with such adjectives as “dynamic” and “exciting”. Her point about this highlights all the more why it’s important for me to bring a diverse range of voices and sectors to our Fantastic Female Fridays audience.

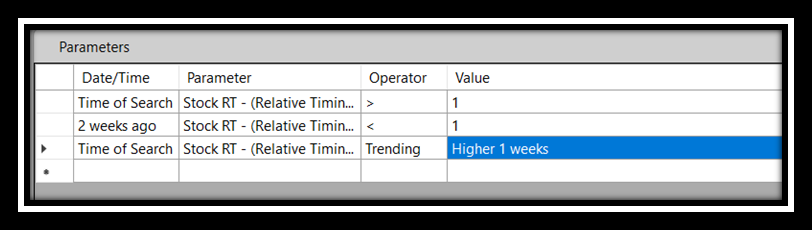

As investors, we’re always looking for new trends. They might be the business models that will shape tomorrow or the new stocks that are set to have an ever higher Comfort Index or Relative Safety rating. However, there is a very clear way at VectorVest where you can find short-term trends very quickly. I like to build a search with three parameters to find them. It’s centered all around Relative Timing – the parameter that analyses a stock’s trend. Specifically, “RT is computed from an analysis of the direction, magnitude, and dynamics of a stock’s price movements day-over-day, week-over-week, quarter-over-quarter, and year-over-year. If a trend dissipates, RT will gravitate toward 1.00.”

I look for three things:

- Relative Timing to be higher than 1 today

- Relative Timing to be less than 1 two weeks ago

- Relative Timing to be trending higher over the past week

This type of search can showcase those companies whereby the buyers are gaining momentum over the sellers.

Science and the City

Laurie’s previous book “Science and the City” can be excellently summarised by the acclaimed Dame Jocelyn Bell’s description “It is future-looking also, describing the technology that will change the world we live in. Therefore, I took the opportunity to ask Laurie about how she feels recent trends have affected the future of our cities. For example, in the UK, the ONS has “found the proportion of working adults who did any work from home in 2020 increased to 37% on average from 27% in 2019 with workers living in London the most likely to homework. A similar proportion of businesses (31%) reported that their workforce was working remotely as restrictions eased in April and May 2021.” This seems a likely trend to “stick”. Even more recently, the soaring cost of petrol and diesel is putting another economic pressure on commuters. The Financial Times reported in March, that “consumer prices in the eurozone have risen faster than the ECB expected for several months, hitting a record annual pace of 5.8 percent in February. On Thursday, the ECB raised its forecast for inflation this year from 3.2 percent to 5.1 percent, citing the “exceptional energy price shocks” stemming from the war in Ukraine.”

Laurie points to three game-changers that can happen in our cities:

- Using the glass in our windows to turn the sun’s energy that streams in through them into electricity for other parts of the building. It’s abundantly available and can make much more efficient use of our surfaces.

- A change in the materials we use to build infrastructure so that it’s much more resistant to flooding. She talks us through the “sponge city concept” that could do so much to alleviate the human and economic suffering that comes with adverse weather events.

- Much more adoption of mass public transport. “As much of a fan as I am of electric vehicles, a traffic jam of electric vehicles is still a traffic jam”, she says.

As she uttered these words, my thoughts wandered back to the example of how much the Industrial Revolution needed the capital markets to turn mass production into a reality. What new financial models do we need today to make these greener ideas a practical possibility?

Has the business ever buried science as a solution that could destruct profit?

There are lots of ways we’ve seen science developments come to pass but then either slowed down due to regulation, politics, or the legal system. Often, this has been for very good reason! Laurie talks about self-driving cars that have been operating for a long time, but we must remember that a car can’t make eye contact with somebody, can’t recognize if somebody has a disability, and can’t make moral decisions. We talked about the themes that have been at the center of previous ESG & Tech shows like how 3D printing could completely change, disrupt even, retail and supply chains. That said, Laurie is absolutely clear about one example when the business has ignored or buried science for its benefit. She points out that the evidence for climate change has been available for decades and now we have so much more to do than if we had taken much greater action, with much greater magnitude earlier on.

As investors, how can we look at the world through a scientific lens?

Laurie’s passion for her subject shines through. You can see that in her tweets, in her books, and the interview. I ask her about what underpins that and I find we have a shared passion – she’s keen to enable people to look at the world from a different perspective. She wants people to see the wonder of science and I love the “glasses” we can teach people to put on through enabling them to understand a company’s potential to grow.

For example, at VectorVest, in one click, you can find out a company’s “one to three year forecasted earnings growth rate in percent per year”. All you need to do is go to Stock Viewer, put your stock into the search bar and then scroll to the right to find the number. For example, on 10th March 2022 Peugeot Invest and Serge Ferrari, both listed in Paris have a GRT of 43%.

Also, we can show in another click on that Stock Viewer, how much investors today are willing to pay for those earnings. This is called the PE (Price Earnings) ratio and it refers to how many euros or dollars or sterling is required to buy one dollar of euros or dollars or sterling of profit. You can find this in VectorVest SDF.DE has a P/E of 16.27. The average P/E of all the stocks in the VectorVest database is 43.19.

We can point out if companies are willing to share some of the profit directly with their investors through a dividend. Further, VectorVest can point out how likely it is that this will remain the case through “Dividend Safety.”

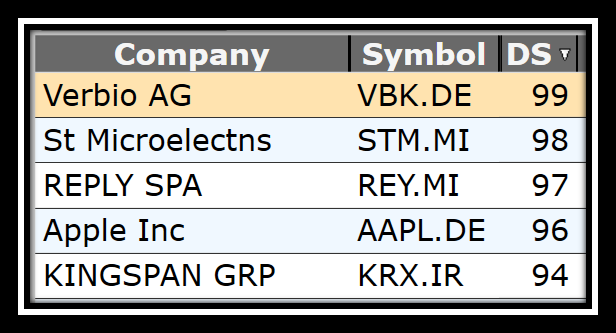

To give you some examples, the five stocks that have the safest dividends in the VectorVest Europe database on 10th March 2022 are Verbio in Germany, St. Microelectns in Italy, Reply SPA in Italy, Apple listed in Germany, and Kingspan in Ireland.

In summary, Laurie Winkless has been a superb guest at Fantastic Female Fridays. She’s given us lots to think about, truly encouraged our audience to look at the world from a sparkling new perspective, offered concrete examples that we can relate to, and posed a variety of ways that science can be tangential to the world of financial markets.

Check out the full episode of our conversation here and please feel free to comment on YouTube with your thoughts.

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment