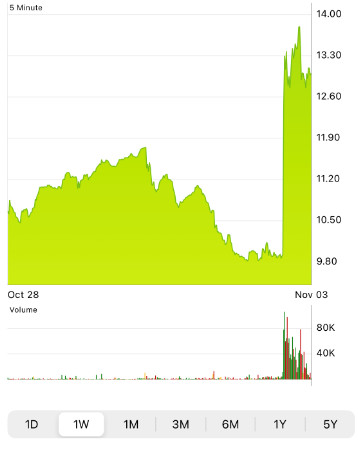

NerdWallet reported an impressive third quarter showing growth in revenue, EPS, and other key metrics. As a result, analysts have moved their price targets for the stock up – and investors have gotten on board as well. Hype after this news has sent the stock up 36% so far this morning. And by the end of this quick discussion, we’ll tell you whether you should buy NRDS stock too – or if waiting is the right call.

To paint the full picture, let’s take a step back and look at the previous year for NerdWallet. If you’re unfamiliar, the company offers online resources and tools to help users take control of their personal finances. The stock took a huge dip and lost around 30% this time last year – and reached its bottom in May of this year, where the stock sat at just $7.38/share.

Since then, NerdWallet has been on the road to recovery. In the past 3 months, the stock has made its way back above $10 – and the positive earnings report released this week has put some more wind in its sails.

While analysts were expecting revenue somewhere in the range of $134 million, NerdWallet reported an impressive $142.6 million. This was a year-over-year improvement of almost 45%. EPS beat anticipations, too – albeit by just $0.01/share. All this growth was the result of improvement in four key segments: credit cards, banking, personal loans, and small and medium-sized business (SMB) verticals.

Looking ahead to the future – which is perhaps more relevant to investors than today’s news – NerdWallet has outlined a plan for additional growth. They are investing in land & expansion, vertical integration, and registrations & data-driven engagement.

All of this has sent NRDS shares to a high point since late January/early February of this year. And, analysts saw it coming. A professional at KeyCorp increased ratings on the stock Monday, October 31 ahead of the earnings release. The new price target of $14 looks to be in play – the only question is, when will it happen?

That remains to be seen. However, in the meantime, what should investors like yourself do with NRDS stock? Is it worth a buy now that the price trend appears to be moving in the right direction? Or, is this just another instance of temporary volatility? After all, the 1-year chart for NRDS has many examples of the stock’s price rising up before falling back to a new low.

For a clear, emotionless answer on your next move with NRDS, take a look through the VectorVest stock forecasting software below.

Excellent Timing vs Poor Upside Potential & Safety

VectorVest simplifies trading by telling you everything you need to know about a stock in just three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

They sit on a scale of 0.00-2.00 – with ratings above 1.00 indicating good performance and anything less indicating underperformance. This makes it easy to analyze stocks at a glance – no emotion, no guesswork. Just tried and true stock analysis. And, the best part is that based on these three ratings, VectorVest actually provides you with a clear buy, sell, or hold recommendation. So, let’s take a look at NRDS below:

- Poor Upside Potential: An indicator of the long-term price appreciation potential, the RV rating for NRDS is poor right now at just 0.52. Moreover, VectorVest calculates the stock to be overvalued at a current price of $13.14. The current value is just $3.32.

- Poor Safety: As you can see by examining all the price volatility on the 1-year graph for NRDS, there is a definite risk to be aware of. But just how risky is it? VectorVest calculates the RS rating to be poor at just 0.67. This is based on an analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: Here’s where things get interesting. The RT rating of 1.50 is excellent – showing a strong price trend has taken hold. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s analyzed day over day, week over week, quarter over quarter, and year over year.

All of this works out to an overall VST rating of 1.04 – which is fair. This begs the question…what should you do now? Should you buy now while the stock appears to be appreciating? Or, do the poor upside potential and safety outweigh the price trend?

You don’t have to play the guessing game or let emotion influence your decision-making. Get a clear, unbiased answer on your next steps through a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NRDS, it has poor upside potential and safety – but excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.