Early this morning Carvana surged 15% before leveling off and dipping back down a bit. However, this is the first positive price movement the online vehicle retailer has seen in quite some time. The reason for this quick jump? The stock was upgraded from “underweight” to “neutral” by an analyst at JPMorgan.

While most analysts – and investors – hate this stock, JPMorgan believes that investors have adequately digested the risk it carries, and are more optimistic about the short and long-term outlook. They don’t have any need to raise capital in the near term. But – after this upgrade, many experts are left baffled by what JPMorgan really sees in the stock that no one else does.

One major issue with Carvana as a business is its current inventory. As we’ve seen the used car market slow dramatically over the past year, it appears the company could end up stuck with vehicles they’re unable to sell. Or, at least, unable to sell at an ideal price point.

The inventory is depreciating rapidly, and consumers don’t seem interested in moving any of their vehicles off the lot – especially pending recession fears. Further making matters worse, Carvana’s inventory is primarily made up of traditional gas-powered vehicles. In a time where consumers are becoming more and more attracted to electric vehicles, this doesn’t bode well for Carvana to be able to move its inventory.

Other analysts echoed this sentiment, mentioning that because Carvana is a 3rd party company not regarded as a dealer, they don’t have the same insights as OEM/dealers. This means they’re the last to know when major shifts are coming in the auto industry as a whole. The end result is that they’re stuck with all that inventory, and no willing buyers.

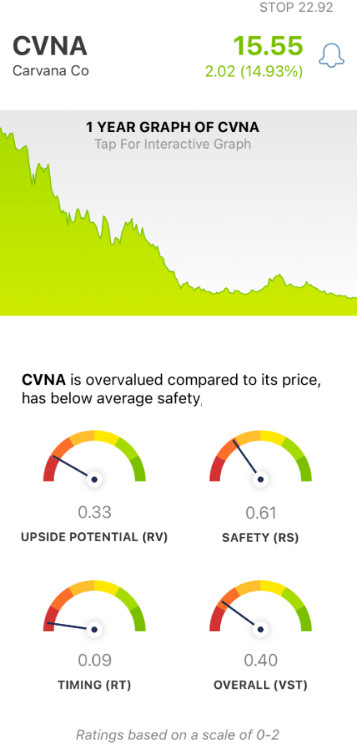

Now, looking at Carvana purely from a stock analysis standpoint, there isn’t really any sort of positive outlook for the company. The stock is down over 90% year to date – even with Tuesday morning’s quick jump. Taking a deeper look at CVNA stock through the VectorVest lens, we’ve identified 3 red flags that the analysts at JPMorgan must have missed…

Very Poor Upside Potential, Safety, & Timing for CVNA Stock

The VectorVest stock analysis tools simplify trading for investors by telling you everything you need to know about a stock in three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. This makes it quick and easy to evaluate the current situation for any given stock at any given time. Just pick the highest-rated stocks to win more trades. The best part? Based on the overall VST rating of a stock, VectorVest can give you a clear buy, sell, or hold recommendation for any stock – including CVNA. So, what’s going on with the online car retailer right now?

- Very Poor Upside Potential: As the used car market shows no signs of picking back up anytime soon, the long-term price appreciation potential for CVNA is very poor – with an RV rating of just 0.33. VectorVest deems the current price of $15.57 to be overvalued. The current valuation is just $4.41.

- Poor Safety: Analysts at JPMorgan feel that investors are better equipped to handle any risk associated with CVNA – but, the VectorVest system calculates a poor RS rating of 0.61. This is derived from a deep analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: Despite the 15% gain today, the timing for CVNA is very poor with an RT rating of 0.09. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. And, it looks at the trend not just day over day, but week over week, quarter over quarter, and year over year.

These three ratings work out to an overall VST rating of 0.40 – which is very poor on a scale of 0.00-2.00. But does that mean you should sell now to recapture any profits possible? Or, should you keep holding to see if this quick pump manifests into a stronger price trend? VectorVest has the answer you’re seeking – analyze the stock free here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for CVNA, it is overvalued with very poor upside potential, poor safety, and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.