What a week it’s been for NGM Biopharmaceuticals – and anyone currently invested in the company. Monday morning NGM stock tanked over 70% – down to $3.07 from $11.53. But today, the stock is making a big move in the other direction, covering 20% of the loss seen just 3 days ago. What happened? How did we get here?

First, know that NBM Biopharmaceuticals is a clinical-stage company engaged in the discovery and development of therapeutics. Specifically, this company’s drugs focus on cardio-metabolic, liver, oncologic, and ophthalmic diseases.

And while the company has had a rough year – things really took a turn at the start of this week. NGM stock was only 30% this year. Considering the state of the overall market, not too bad. However, Monday morning the company was forced to acknowledge a drug failure – and one that had been highly anticipated.

The company’s eye disorder candidate NGM621 failed the Phase II CATALINA Trial. The drug was unable to show statistically significant changes compared to the control injection over the 52-week trial. And while NGM Biopharmaceuticals pointed to potential reasons for the failure – and ways they could improve results going forward – analysis and investors alike reacted poorly to this news.

One analyst from Jeffries – Dennis Ding – summarized it best by simply calling it “a disappointment”. And while he does agree with NGM that there is still potential for this drug, he doesn’t see a clear path forward.

As a result of all this, analysts like Ding lowered their price targets for NGM – while dropping their ratings from buy to hold.

However, those investors who stayed loyal to NGM and held onto their position didn’t have to wait long to see a rebound. Just Tuesday morning the stock bounced back up about 9%. And now, Thursday morning, the stock is making even bigger moves in the right direction. It’s up 25% as of 11:30 AM EST – and it doesn’t seem to be slowing down.

What caused this quick turnaround in momentum? Will this trend continue?

To help answer a few of your questions, we can take a look at NGM stock through the VectorVest lens. This intuitive stock forecasting software can give you a clear buy, sell, or hold recommendation for any given stock at any given time. Whether you’re currently invested in NGM or are looking for an opportunity to ride the wave, you’re going to want to see this first…

3 Red Flags You Need to See Before Your Next Move With NGM Stock

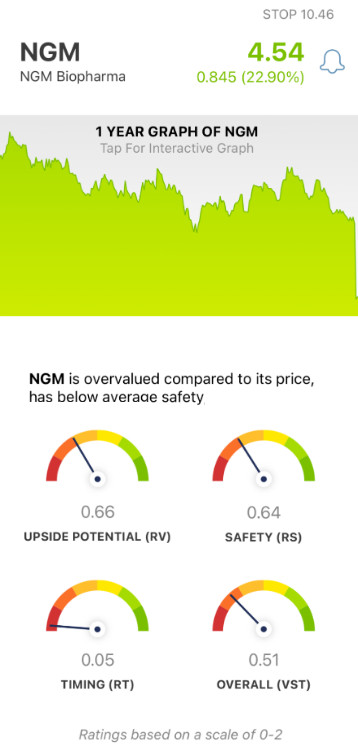

The VectorVest system simplifies the stock analysis by boiling down everything you need to know about a company into three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These ratings are placed on a scale of 0.00-2.00, making interpretation effortless. The closer a stock is gravitating towards 2.00 in any given category, the better – and vice versa.

Based on these three ratings, the VectorVest system provides you with an overall VST rating for the stock – along with a clear buy, sell, or hold recommendation. This will change the way you invest – no matter your strategy. So, what’s going on with NGM?

- Poor Upside Potential: Based on the current price of $4.54, NGM stock is overvalued. VectorVest calculates the current value to be just $3.18. Moreover, the RV rating of 0.66 is poor on a scale of 0.00-2.00 – suggesting low long-term price appreciation potential.

- Poor Safety: An indicator of risk, this rating takes into account a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. All this considered, NGM has a poor RS rating of just 0.64.

- Very Poor Timing: This rating grants investors insights into the price trend for a stock – day over day, week over week, quarter over quarter, and year over year. It looks at the direction, dynamics, and magnitude of a stock’s price movement. And while NGM has shown incredible fortitude with the quick rally after Monday’s nightmare, the RT rating of 0.05 is very poor. To show a true price trend in the right direction, this rating needs to cross over 1.00.

All of this adds up to an overall VST rating of 0.51 – which is poor on a scale of 0.00-2.00. Does that mean you need to sell your shares now? We know you came here hoping for a clear recommendation on what your next move should be – and VectorVest can provide that. Get a free stock analysis here to execute your next trade in confidence.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NGM, it is overvalued with poor upside potential and safety – and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.