ESG & Tech Show – Fastest Growing ETFs

During the latest episode of the ESG & Tech Show, I considered multiple perspectives on the theme of the “fastest-growing ETFs” as it’s worthwhile to consider this from different angles.

I’ve examined ETFs many times in the show and a brief explainer points out that ETFs are simply funds that trade on an exchange, passively track an index (most of the time), transparently publish their holdings (again, most of the time) and are a simple, diverse, low-cost product.

To get us started on this theme, I noted the striking milestone that screamed from the Financial Times recently. “Passive fund ownership of US stocks overtakes active for the first time”. The piece went on to quote a study from the Investment Company Institute that observed “Passive funds accounted for 16 percent of US stock market capitalization at the end of 2021, surpassing the 14 percent held by active funds … a sharp reversal of the picture 10 years ago, when active funds held 20 percent of Wall Street stocks and passive ones just 8 percent”. Interestingly, the article mentions ICI data show ETF investors tend to be younger — with the average age of the head of the household 45, versus 51 for mutual fund owners.

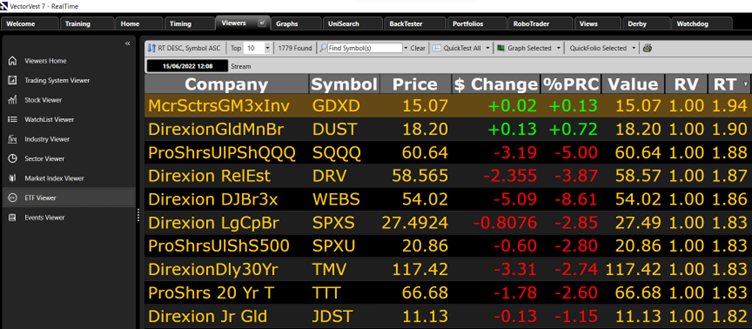

I’ve been at countless webinars and in-person sessions to know that many of our subscribers, particularly in Europe, aren’t very comfortable with using leveraged products and so, the next thing to do is apply some filters. VectorVest has done some of the thinking for you when it comes to this… but it may not be how you think!

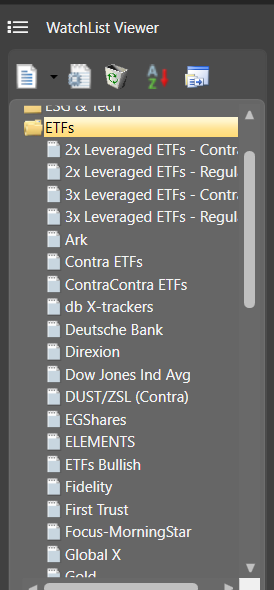

It may sound like the right thing to do here is jump straight into Unisearch and build a search. However, I suggest otherwise. Talk a little detour before you go there. Check out the “Watchlist Viewer” and then delve into the folder of ETF watchlists. Please note that we don’t have a specific watchlist folder dedicated to ETFs in Europe but there are lots and lots in the US.

Perhaps you might want to solely look at ETFs that offer bullish exposure, there is a watchlist there for you. If you particularly like one ETF provider (i.e. iShares is the biggest in the world), there is one there for you. If you want to look solely at Gold ETFs, then there is one sitting there waiting for you. As I did with the audience today, take a little time to check these out before then, duly going to Unisearch. My rationale for this is that you can then use the following field very productively:

Stock Watchlist = <Selected Watchlists>

If you know the key characteristics that you’re looking for in an ETF and the watchlist is there for you, it’s simple then to move on to your next criteria. That might be a dividend yield, with and Relative Timing level above 1 or that has recently been moved from a “Hold to a Buy”, for example. Also, remember that you can rank the resulting search by the metric you feel is most important. Again, Relative Timing can be an appropriate candidate here.

The ETF industry itself is growing all the time due to investor demand and nuance. According to the “National News”, the global exchange-traded fund industry attracted $80.28 billion in May, bringing net inflows this year’s inflows to $417.87bn, even as inflation concerns and US Federal Reserve rate increases weigh on markets, a report has said. Assets invested globally in the ETF industry hit $9.46 trillion at the end of May, up 1 percent from $9.36tn at the end of April. Statista highlights the massive growth in the sheer number of funds with “There were 8,552 ETFs globally in 2021, compared to 276 in 2003.”

Naturally, given the name of the show, I felt it was important to address the fact that ESG ETFs have underperformed the traditional, market-cap-weighted indices this year. This was well discussed in a very recently published VettaFi podcast and fact, the editor-in-chief Lara Crigger pointed out that only $1 in $100 invested in ETFs in the US is invested in the ESG space. However, that made me think. I don’t think that only 1% of ETF funds are given sustainability consideration. I think that it’s a lot more but there are many more tools out there now to examine ESG than ever before. For example, I can go to the iShares site and check the sustainability metrics of any one of its own ETFs. As a result, I may not necessarily be buying an ESG ETF, as per the label on the fund, but I certainly may be using ESG data to help me make my decision. I’m not challenging Lara’s figures but I think it’s a good idea to consider what makes those numbers stack up. That said, it still is the case that ESG ETFs have underperformed this year and I wanted to explain why (through a story that happened during the show).

A regular viewer asked about the stocks that underpin an ETF and how that approach may be better. In answer to her, I brought the audience on a little treasure hunt. I started by showing the Stock Viewer, in its entirety (and thus, not just ETFs). I ranked all of those stocks in terms of VST (Value Safety and Timing) so that the best combination of fundamental and technical indicators rose to the top. I scrolled over to the right to see if I could spot a sectoral trend and of course, one jumped right out at me (at the time of writing).

There was a range of petroleum stocks in the top ten and so, I took my lead from there. I then went to the iShares site and searched for some sector-specific ETFs in this area. I came across “IEZ”, an ETF offering exposure to the US Oil Equipment and Services through an ETF (with an impressive 42.73% return so far in the year to date). I then looped back to VectorVest to run a full stock analysis report and glean all the insights open to me on that document. As you can imagine, several ESG ETFs either don’t have these energy companies in them at all or may be underweight due to the environmental impact of their operations. This can speak to the chasm in between their returns in 2022.

One last point! I did promise to highlight some innovation within the ESG space during the episode and I wanted to highlight the “IQ Dual Impact ETFs”. Apart from diverting your money into the causes underpinning the funds, these ETFs donate some of their management fees to give extra help to the not-for-profits they partner with. This is a new development and I wonder if we will see changes in ETF’s business models, tactically, as they go along to always strive to differentiate themselves in an ever-competitive playing field with both more supply and demand.

Register at www.vectorvest.com/fff so that you can be notified of all upcoming episodes and receive the follow-up summary directly into your inbox.

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.