Autodesk (ADSK) investors have been anxiously awaiting an update since April 1 of this year after the company became aware of potential discrepancies in its free cash flow and non-GAAP operating margin practices.

This led to the delay of its 10-K for fiscal year 2023 pending a full investigation into the issue, resulting in the stock falling as much as 22% over the past few months. However, it appears investors finally have some closure on the problem – there will not be any restatement or adjustment of past financial results.

CEO Andrew Anagnost took a moment to thank investors for their patience and loyalty while the company worked to figure out what was going on. He said the company does not take matters like this lightly and wanted to take their time to get things right.

ADSK is now up 5% today as the road to recovery is well underway for the stock. But it’s not just the closing of this chapter that is sending shares higher. The company also teased preliminary results for the fiscal first quarter, which appear to have beat the analyst expectations.

Autodesk is expecting to deliver earnings on an adjusted basis of $1.87 per share alongside revenue of $1.42 billion compared to the consensus of $1.74 per share and $1.39 billion respectively.

Analysts with Stifel and Oppenheimer are bullish on the stock, with price targets ranging from $275 to $290. ADSK currently sits at just $236 per share after losing market cap over the past few months.

Investor confidence is now restored and will only get stronger with the official release of the company’s 10-K and first-quarter earnings results. That being said, is now a good time to buy this stock?

We’ve taken a closer look at the opportunity through the VectorVest stock analysis software and found 3 reasons to consider investing in ADSK if you haven’t already.

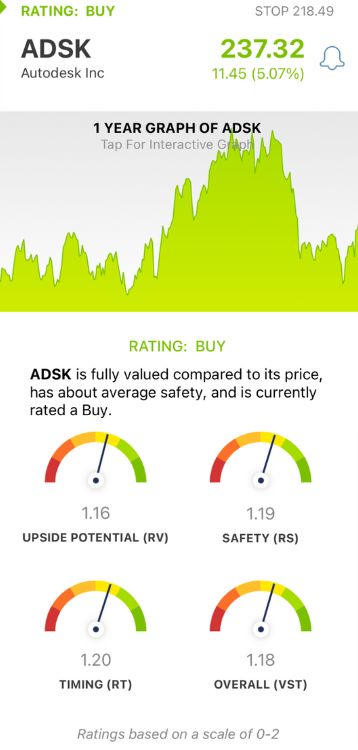

ADSK Has Good Upside Potential, Safety, and Timing, Earning it a BUY Recommendation in the VectorVest System

VectorVest is a proprietary stock rating system designed to save you time and stress while empowering you to win more trades. It does this by delivering actionable insights in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating is placed on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. It gets even better, though, as the system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for ADSK:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. ADSK has a good RV rating of 1.16 right now.

- Good Safety: The RS rating is a risk indicator computed from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors. ADSK has a good RS rating of 1.19 right now.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. ADSK has a good RT rating of 1.20 right now as the stock is finally turning things around.

The overall VST rating of 1.18 is good, and enough to earn the stock a BUY recommendation in the VectorVest system. But before you do anything else, take a second to look over this free stock analysis so you can make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ADSK has climbed 5% so far Monday morning after announcing that the internal financial probe is officially closed, and no further action will be necessary. The company also released promising preliminary Q1 results. The stock itself has good upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.