Over the past few years, Royal Philips (PHG) has been battered and bruised amidst concerns surrounding its devices being recalled and the implications of a settlement.

The uncertainty has led to the stock getting cut nearly in half since 2021 when these issues were first noted. Its breathing devices and ventilators were created with a foam that could degrade and expose the user to carcinogens.

However, the Amsterdam-based medical device manufacturer sees light at the end of the tunnel as it has reached a settlement in the realm of $1.1 billion. This will tidy up all personal injury claims filed in the US.

While it sounds like a lot, there was an expectation that the figure would come in between $2-4 billion – with a worst-case scenario reaching as high as $10 billion. All things considered, Philips and its shareholders should be thrilled with the outcome.

Now, it’s important to note that this only buttons up the lawsuits here in the US – there is still work to be done in Europe. CEO Roy Jakobs says that for the most part investors can take a sigh of relief on the news.

Philips did not admit any wrongdoing on its part. But, the company will need to make improvements to its US-based respironics plants after receiving the final details of the consent decree US authorities handed out earlier this month.

The manufacturer has also settled for $580 million with insurers over product liability costs. This payment will come in the next quarter. Philips has already put aside 982 million euros to help fund these payments.

This “good” news, if you want to call it that, was accompanied by solid first-quarter earnings results. The company grew comparable sales by 2.4% while its profit margin soared 9.4%. This resulted in an 8% jump in adjusted earnings.

All things considered, where does this leave current or prospective PHG investors? We’ve dug deeper into the VectorVest stocks software and found 3 things you need to know about this stock.

PHG May Have Poor Upside Potential and Safety, But Excellent Timing Earns the Stock a Buy

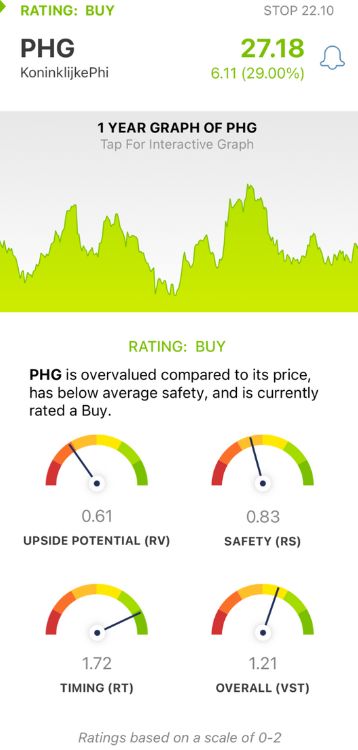

VectorVest simplifies your trading strategy by delivering clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

You’re even given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating, eliminating any guesswork or uncertainty from your decision-making. Here’s what we found for PHG:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insight than the typical comparison of price to value alone. PHG has a poor RV rating of 0.61. The stock is overvalued as it stands with a current value of just $12.70.

- Poor Safety: The RS rating is a risk indicator. It’s calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. PHG has a poor RS rating of 0.83 right now.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As you can see from the stock’s recent performance, it has excellent timing - the RT rating of 1.72 reflects this.

The overall VST rating of 1.21 is good - so, does excellent timing outweigh poor upside potential and safety, or is it the other way around?

VectorVest rates PHG a BUY today - but you’re going to want to get a free stock analysis to learn more about this opportunity to effectively capitalize on it. Transform your trading strategy for the better today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PHG is finally ending the uncertainty surrounding its personal injury claims with a whopping $1.1b settlement. The stock popped 30% on this news, along with excitement surrounding an impressive Q1 performance. The stock itself has poor upside potential and safety, but excellent timing is enough to earn it a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.