It was a bad start to the week for a big chunk of Spotify’s (SPOT) workforce after the company announced Monday morning that 17% of jobs would be cut. CEO Daniel Ek didn’t mince words, admitting that many smart, talented, and hardworking individuals would be let go.

This is now the third round of job cuts in 2023. The first came in January when Spotify announced that 6% of its workforce would be cut, but this was followed by another 2% slash in June.

Ek blamed these cuts on a dramatic slowdown in economic growth as capital is becoming more and more expensive. He says that Spotify is just like the rest of the tech industry that is feeling these effects.

The company burgeoned during the pandemic, as did many tech companies. Spotify made the mistake of thinking this growth would be their new normal – but as the dust has now settled, it’s clear that the hiring spree between 2020-2021 was overzealous.

Ek reiterated that this is a matter of “rightsizing” costs within the company for its new economic reality. That being said, the company reported more than $70 million in profit for the third quarter after the first two rounds of job cuts coupled with drawing back its marketing spend. The company also raised prices on its subscriptions to bolster profitability.

The company has around 9,200 employees left standing after the first two rounds of cuts this year, meaning more than 1,500 individuals will be left unemployed after this round. And with the holiday season in full swing, it couldn’t have come at a worse time.

Still, business is business. The market as a whole looked at this as good news, sending shares of SPOT nearly 11% higher in Monday’s trading session. As of noon EST shares have settled at just under a 9% gain on the day.

All things considered, is this good or bad news for investors? We’ve taken a look at SPOT through the VectorVest stock analysis software and have 3 things you need to see.

Despite Fair Safety and Very Good Timing, SPOT Has Very Poor Upside Potential

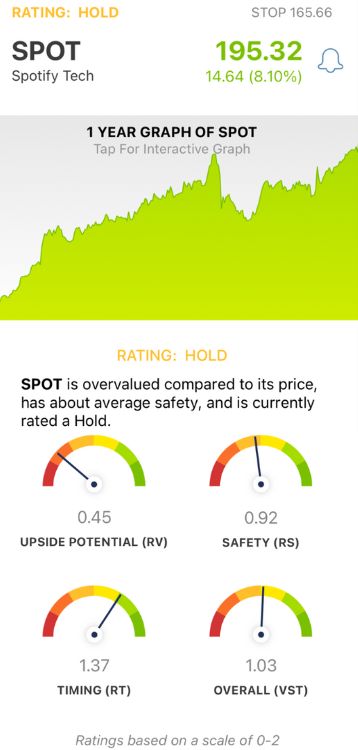

VectorVest simplifies your trading strategy by giving you clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-interpret scale of 0.00-2.00, with 1.00 being the average. You’re then given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s the current situation for SPOT:

- Very Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. SPOT has a very poor RV rating of 0.45. The stock is massively overvalued with a current value of right around $19/share.

- Fair Safety: The RS rating is an indicator of risk. It’s computed through a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors. SPOT has an RS rating of 0.92, which is a bit below the average but deemed fair nonetheless.

- Very Good Timing: The one thing this stock has going for it right now is very good timing, as the stock has now rebounded 146% in the past year. The RT rating of 1.37 reflects this performance. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.03 is just above the average and deemed fair - but it leaves the stock in limbo with a HOLD recommendation in the VectorVest system right now. Learn more with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SPOT is up nearly 9% after reporting its third round of cuts this year. That being said, the stock may have very good timing - but its safety is just fair, and its upside potential is very poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.