Fisker Inc. (FSR) fell off a cliff after reporting third-quarter earnings after the bell Monday. Shares are down more than 21% in Tuesday morning’s session so far, and the stock has lost more than 42% of its value in the last month.

The electric vehicle manufacturer posted a steep loss for the quarter of $91 million (27 cents/share). This was worse than analysts were forecasting, as the consensus called for a loss of 23 cents a share.

While this was an improvement year over year compared to $149.3 million (49 cents/share), the difficulties of achieving profitability as an EV maker are becoming more and more apparent for Fisker.

Revenue did climb to $71.8 million, a dramatic increase from the $14,000 reported a year ago. Fisker reported just $825,000 last quarter, too. This was the first quarter with meaningful sales from its vehicles. However, analysts were expecting sales of $143.1 million for the quarter.

Production grew to 4,725 vehicles in the quarter and nearly 1,100 were sold. The company has placed an emphasis on scaling further in the 4th quarter and beyond by optimizing last-mile logistics and expanding its delivery infrastructure.

As for now the company has delivered more than 3,000 vehicles around the world and there are hundreds more loaded on delivery vehicles right now making their way to customers. But is profitability going to continue to suffer at the cost of making sales? The company has lowered prices on the Fisker Ocean already.

Looking ahead to the remainder of 2023 Fisker doubled down on its forecast, keeping operating expenses and capital expenditures between $565 million and $640 million. But while the company initially forecasted gross margins between 8% and 12% for the year, they have removed that guidance altogether.

As the company’s losses continue to widen, we’ve taken a look at FSR through the VectorVest stock analyzer and found 3 reasons it may be time to consider cutting losses on this stock.

FSR Has Poor Upside Potential With Very Poor Safety and Timing

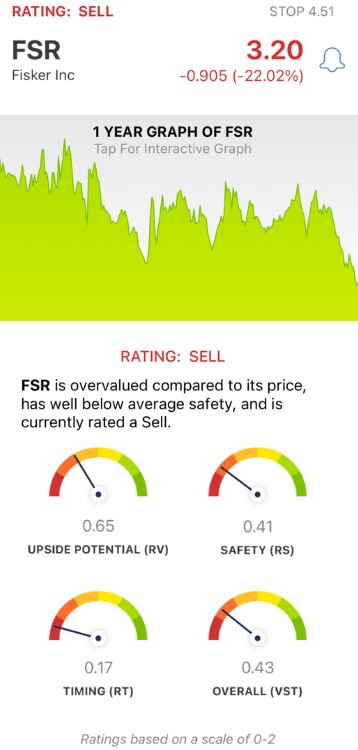

VectorVest simplifies your trading strategy by giving you all the insights you need to make clear, calculated decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average. This allows for quick and easy interpretation. But, it gets even easier. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for FSR, here’s what you need to see:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year forecast) to AAA corporate bond rates and risk. It offers far superior insights than a simple comparison of price to value alone. As for FSR, the RV rating of 0.65 is poor. Moreover, the stock is overvalued even after losing more than 60% of its value in the past year - its current value is just $1.40.

- Very Poor Safety: The RS rating is an indicator of risk. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors. FSR has a very poor RS rating of 0.41.

- Very Poor Timing: The biggest issue for FSR is the very poor RT rating of 0.17, which reflects its steady fall to the bottom since reaching a price of $28/share a few years back. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.43 is very poor for FSR, and indicates that it is time to SELL this stock if you’re currently holding shares. Learn more by getting a stock analysis free today and transform the way you trade for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. FSR is down 21% today as losses continue to mount and the company struggles to achieve profitability. The stock has poor upside potential, very poor safety, and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.