Shares of WeWork (WE) have been in a complete free-fall for the past year and it’s only getting worse. The stock has fallen more than 22% in Tuesday morning’s trading session after the company decided to forego bond interest rate payments despite having the means.

The company is withholding $37.3 million in cash and $57.9 million in in-kind payments across 5 of its bonds. The company does have ample liquidity to meet its obligations but has chosen not to as part of its strategic plan.

There will now be a 30-day grace period at which point negotiations will commence with bondholders for better terms. The bonds are considered distressed at a valuation of just 9 cents on the dollar.

The co-working firm says that not only will this allow for discussions with certain stakeholders in the company’s capital structure but it will also enhance liquidity. The interest payments will be used to implement parts of its strategic plan. This includes rationalizing its real estate footprint and optimizing its capital structure.

WeWork is also looking to renegotiate all its leases worldwide. It seeks to exit a few unfit locations, but for the most part, intends to stay in its 777 locations – on better terms, hopefully. This move to renegotiate could prove costly to the commercial real estate industry as a whole which is already distressed.

Just a few months back in August we wrote about WeWork admitting to substantial doubt the company could stay afloat. At the time, shares had fallen on news of a $397 million loss in the second quarter – reaching as low as 17 cents/share.

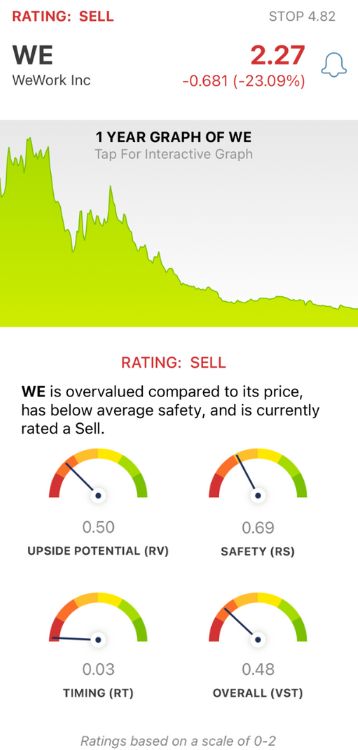

While shares sit at $2.31 today, it doesn’t appear that things are going to get better anytime soon. In fact, we’ve taken a look at WE through the VectorVest stock analysis software and uncovered three more reasons to consider selling this stock and cutting losses. Here’s what you need to know…

WE Has Poor Upside Potential and Safety With Very Poor Timing

The VectorVest system tells you what to buy, when to buy it, and when to sell it - eliminating human error and guesswork from your investment strategy. It does all this in just 3 simple ratings to save you time and stress, too: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-interpret scale of 0.00-2.00 with an average of 1.00, allowing for quick insights. But it gets even better as you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on these ratings. As for WE, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. WE has a poor RV rating of 0.50 right now. The stock is overvalued, with a current value of just $.60.

- Poor Safety: The RS rating gives insights into risk. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for WE, the RS rating of 0.69 is poor.

- Very Poor Timing: The biggest issue for WE right now is the fact that it’s lost 99.42% of its value since IPO. The stock has lost 78% in the past 3 months alone. As a result, the RT rating of 0.03 is very poor - about as bad as it gets. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.48 is very poor for WE - VectorVest says it’s time to cut losses and sell any shares you have left, as painful as it may be. But, you can learn more and get a real-time update on WE through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WE is down more than 22% today after foregoing bond interest payments, adding to what has been a dramatic fall from grace. The stock has poor upside potential and safety with very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.