by Leslie N. Masonson, MBA

The investment arena is very large with multiple stock exchanges listing thousands of companies, over 26,000 mutual funds with multiple share classes, and 3,149 ETFs, as well as options on stocks and ETFs, and Futures, among other choices. How does an investor or trader decide where to start? That response would take multiple articles to delve into in depth. Instead, this article will strictly focus on the most innovative investment opportunity in the last three decades – Exchange Traded Funds.

That is one reason I have already provided eight previous articles on ETFs in this blog with many more to come. Investors and traders need to know as much as about this investment vehicle with enormous choices and low cost. Moreover, ETFs will be the leading way in offering the best opportunities to invest for many decades to come, and will continue to be the “game-changer” for all types and ages of participants.

In your reading or monitoring the markets through print or online, you will come across ETFs mentioned by so-called “market strategists” and “gurus”. Obviously, take their comments with a grain of salt until you check them out by placing them in a watchlist, and consider using the VectorVest software which excels at analyzing stocks and ETFs with a 30-year track record of accurate market timing calls.

Three Ways to Develop Watchlists

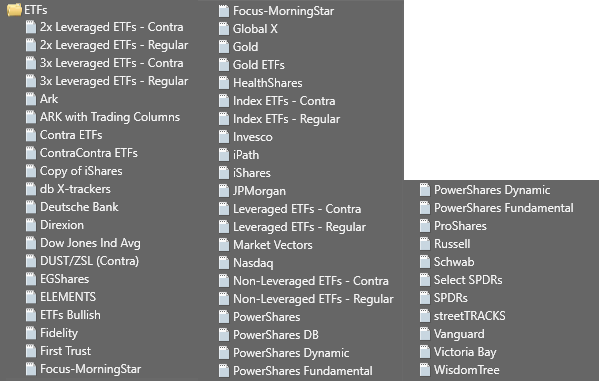

Whether you are looking to invest or trade in your standard brokerage account or retirement account, it pays to track ETFs for each purpose in different watchlists. Let’s discuss checking out a few VectorVest watchlists. Clicking on the “Viewer” tab on the homepage brings up a list of eight viewers with one labeled “Watchlist Viewer.” Opening that tab brings up a list of about ten choices, one of which is labeled “ETFs” that contains over 50 ETF choices (see listing below).

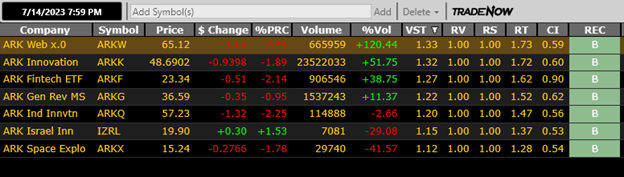

For example, if you were interested in checking out the ARK ETFs for your trading account, refer to a portion of the screenshot below, as of the close on July 14. As we can see, ARKW was the top-ranked ETF by VST, VectorVest’s master indicator, with a reading of 1.27 on a scale of 0 to 2.00. All the ETFs are rated above 1.00 the bullish/bearish line in the sand. They are all rated a “BUY”. Also, notice that ARKK has the largest daily volume of over 23 million shares while IZRL has the lowest at just above 7,000. The next step is to graph these ETFs to determine which ones have the best chart patterns and are rising in price above their 40-day moving average.

You may then decide to eliminate the ones from this list with weak charts and rename the watchlist with your first name -- ARK John – and keep the original list for future reference. You can use the same approach on any of the other ETFs in this list. If you were selecting ETFs for your retirement account watchlist, you may want to focus on those higher RS (Relative Safety) and RV (Relative Value) ratings in some of the other choices such as iShares (298 ETFs offered) or Vanguard (74 ETFs offered).

Another way to find ETFs to place in watchlists is to use the ETF Viewer as mentioned two weeks ago (June 30 blog) which ranks them all by VST. Moreover, you can rank the ETF by any of columns of your choice, highlight the top 5 or 10 and place them in a watchlist with a mouse click.

A third way to find ETFs for a watchlist is to use the UniSearch tool reviewed in last week’s blog – UniSearch ETF Tool – The Basics (July 11, 2023). There are over 40 choices listed under the “ETFs'' section, and many of the search choices on the overall list can be adapted to ETFs by changing the Time of Search parameter to Stock Sector = ETFs. Specific searches that have had above average performance over years include: Jail Break-No Contra ETFs, Rising ETFs, Best Performing ETFs Buying Contra ETFs, and Worst Performing Contra ETFs.

In summary, combining the analytical power of VectorVest, the best ETF candidates can be identified and tracked using watchlists. And then investing and trading decisions can be made with a high degree of confidence, as emotions are not involved in the decision-making criteria.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.