The Walt Disney Company (DIS) is coming off a tough week of letting thousands of workers go, and it appears that a new battle awaits them this week. Monday morning, the Central Florida Tourism Oversight Board unanimously voted that they would sue the entertainment company.

This is just the latest in an ongoing political battle between the company and Florida Governor Ron DeSantis. It all started when Disney’s previous CEO, Bob Chapek, opposed DeSantis’ decision to ban any discussion of gender identity and sexual orientation in classrooms up until the 3rd grade.

You’re probably wondering – what exactly is the Florida board suing Disney for? It’s not evident if the board themselves even knows what they’re suing for. In fact, Disney actually sued them first over a breach of a previous agreement.

Lawsuits aside, Disney is in the midst of a large restructuring effort since bringing beloved CEO Bob Iger back in late November of last year. As part of that, the company is expecting to lay off 7,000 individuals before this summer – which is right around the corner.

These layoffs span the gamut of Disney’s various segments – from Parks, Experiences, and Products to Disney Entertainment, ESPN, and Disney+.

All of this is part of Iger’s focus on increasing profitability. Along with shedding more than $4b in costs last year, the company is discovering new revenue streams. One of these is the new ad-supported streaming tier. Disney has also raised prices to help offset some of the steep losses associated with streaming.

The overarching goal is to be profitable in streaming by 2024. With the clock ticking, the last thing the company needs is setbacks or distractions from legal battles. Today’s news sent shares down about half a percentage point so far in Monday’s trading session.

With all this said, does DIS still deserve a spot in your portfolio? Or, is this a tumultuous time for the company that you should shield yourself from? We’ve taken a look at the company through the VectorVest stock analysis software and have 3 things to help you make your next move with confidence.

While DIS Has Poor Upside Potential, the Safety & Timing Are Still Fair

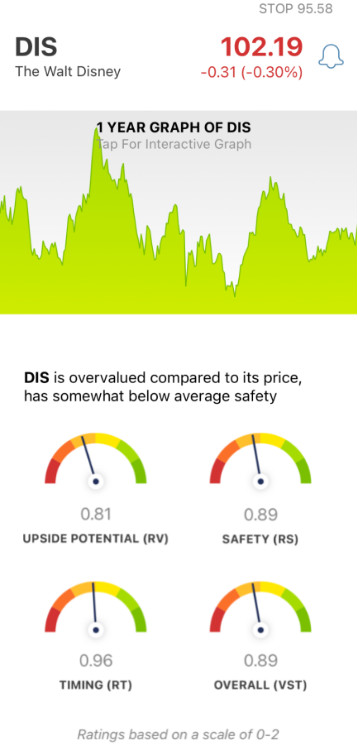

The VectorVest system simplifies your approach to trading by telling you what to buy, when to buy it, and when to sell it. You’re given clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average. But, based on the overall VST rating for a stock, VectorVest is able to give you a clear buy, sell, or hold recommendation - at any given time. As for DIS, here’s what you need to know:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential alongside AAA corporate bond rates and risk. And right now, the RV rating of 0.81 is poor. Making matters worse, the stock is overvalued right now. The current value is just $56.

- Fair Safety: In terms of risk, DIS is a fairly safe stock - even though the RS rating is below the average at 0.89. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: In terms of price trend, there isn’t much to be excited about right now - the RT rating is just 0.96, but is considered fair nonetheless. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.89 is below the average - but still deemed fair. So, what does that mean for you as an investor? Should you wait out this storm, or find a better opportunity? Don’t play the guessing game or make a decision based on emotion. Get a clear answer on your next move through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for DIS, it is overvalued with poor upside potential. But, the safety and timing are fair right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.