It’s been a tough morning for Elon Musk, as not only did SpaceX Starship fail mid-flight – Tesla’s (TSLA) 1st quarter earnings came in overnight and the response has been anything but positive.

The company is in the pits of a profitability battle that resulted in a drop to 11.4% in operating margin. This came after price cuts on the EV lineup in multiple instances throughout the quarter. While this figure is still leaps and bounds ahead of other automakers (GM at 6.6% and Ford at 4%), it’s a huge step backward for the company.

And, it appears things are only going to get worse as Musk anticipates future price cuts as well. He states that from the Tesla viewpoint, a model that prioritizes volume over profitability makes more sense. As demand continues to suffer amidst this challenging economic environment, offering Tesla vehicles at a discount will be the response.

Despite the profitability concerns for Tesla, the company did experience a nice bump in revenue – up 24% to $23.33 billion. This was in line with the analyst estimates. And, it gives hope to investors that maybe Musk’s strategy of volume over profitability could work out.

Experts claim that what Tesla is doing right now is similar to Ford in the early 1990s – using innovation as a way to push competitors out of contention. While Tesla’s shrinking margin is no doubt a concern to investors, they have the room to do it. Should they continue to drive prices down, competitors will not be able to keep up.

With that said, Tesla stock took a hit as a result of the Q1 earnings release. The stock is down more than 7% so far in Thursday’s trading session. The stock has finally begun moving in the right direction in the past 3 months with a 31% rally.

So, what does this latest news mean for investors – is it a sign of what’s to come for the remainder of the year? Or, is this just a temporary market reaction that you should tune out?

In January, we wrote about Musk’s lack of focus on TSLA and issued a warning to investors. And today, we’ve taken another look at the company through the VectorVest stock analyzing software. We’ve got 3 things you need to see now…

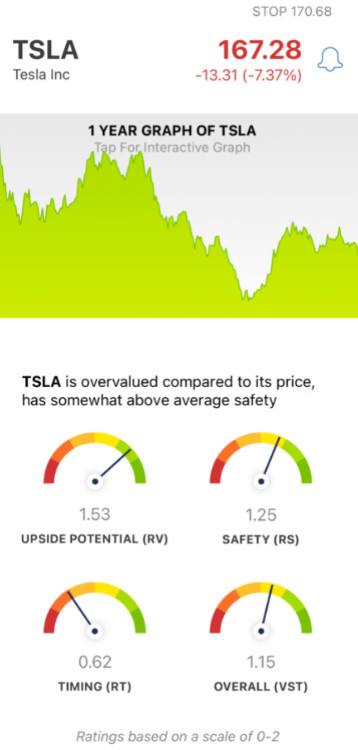

Despite Excellent Upside Potential and Very Good Safety, the Timing for TSLA is Poor

The VectorVest system helps you simplify your trading strategy by telling you what to buy, when to buy it, and when to sell it. With just 3 ratings, you’re given all the insights you need to feel confident in your decision-making.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average - allowing for effortless interpretation.

But, it gets even easier for you - because based on this proprietary stock rating system, VectorVest also provides a clear buy, sell, or hold recommendation for any given stock, at any given time. As for TSLA, here’s what you need to know…

- Excellent Upside Potential: The RV rating is an indicator of a stock’s long-term price appreciation potential (3 years out) compared to AAA corporate bond rates and risk. And right now, the RV rating of 1.53 is excellent for TSLA.

- Very Good Safety: In terms of risk, TSLA is a very safe stock right now - as indicated by the RS rating of 1.25. This rating is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The one thing holding TSLA back is poor timing - with an RT rating of just 0.62. This is calculated from the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.15 is good for TSLA…but does that mean you should buy, sell, or hold this stock? Don’t play the guessing game or let emotion influence your decision-making. A clear answer awaits you at VectorVest - get a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite the excellent upside potential and very good safety for TSLA, it has poor timing right now - and this is likely only going to worsen after the negative Q1 earnings release today.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.