Perion (PERI:Nasdaq) is a global technology innovator headquartered in Holon, Israel. It operates in the digital advertising space across three pillars—ad research, social media and display/video/CTV products and services. The company was founded in 1999, employs 500 individuals, and maintains nine offices in Tel Aviv, Paris, New York, London, Chicago, Boston, Kiev, Barcelona, and Seattle. Some of the company’s partners include: VISA, Nike, Mercedes, McDonald’s, BMW, HBO, Starbucks, Target and many others.

In its February 8, 2023 earnings release, it reported a 119% year-over-year net income growth in the 4th quarter of 2022. Moreover, it had a three-year EBITDA CAGR of 101% and a revenue CAGR of 40%, certainly a powerful performance considering the global pandemic, supply chain issues, rising interest rates, and emotional responses from advertisers and brands.

PERI has a low P/E ratio of 16.08, well below that of average VectorVest stock at 45.90,and quite appealing to conservative investors. Moreover, it has forecasted earnings per share of $2.38 for the year ahead. The average daily trading volume of nearly 785,000 shares is more than sufficient for obtaining favorable trade executions. And 52% of its shares are held by institutions. The company does not pay a dividend.

VectorVest ranks PERI #1 in its universe of 29 Educational and Entertainment Software industry grouping, as well as #1 out of 451 stocks in the Software sector. That is quite a dual-barreled accomplishment. These high rankings are understandable with its strong 33% sales growth over the past year, and its solid historical earnings growth.

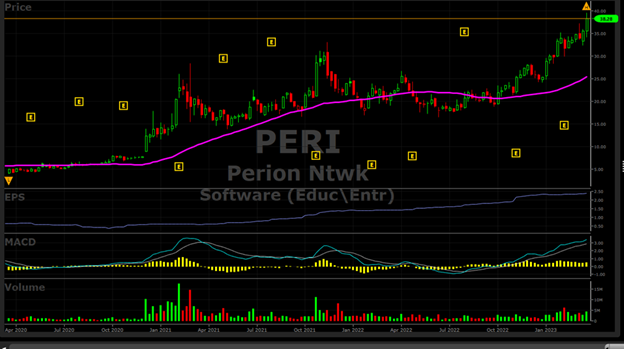

Currently, the stock price is well above its 40-day moving average which is not the case for the Dow-Jones Industrial and Nasdaq Composite, although the S&P 500 just closed above that level on Friday. The stock has had a great run from its recent low on September 26, 2022 at $18.84 to its all-time high on Thursday March 23, 2023 of $38.21, a run up of 103%, while the S&P 500 Index by comparison actually gained only 7.9%. Thus, being in best performing market segments, such as software, is critically important to portfolio performance. That is where VectorVest excels, and runs rings against its competitors. With a few mouse clicks, the Stock Viewer pinpoints the top stocks comparing all stocks against each other, bringing the leaders to the top of the screen for further analysis and a technical chart review.

PERI is Undervalued with above Average VectorVest Scores a Rising Stock Price and a Strong Financial Performance

The VectorVest ratings of TORM are as follows:

- Excellent Upside Potential: The Relative Value (RV) rating focuses on a stock’s long-term, three-year price appreciation potential. The current RV rating for PERI is 1.41 which is much higher than average on a scale of 0.00-2.00. VectorVest’s current value of this stock is $45.74 that is significantly higher than its current price of $38.28; therefore it is considered undervalued with room to exceed its recent high.

- Fair Safety: The Relative Safety (RS) rating is based on the company’s business longevity, financial predictability/consistency, debt-to-equity ratio, and additional risk parameters, including price volatility. Its RS rating of 0.94 is slightly below average, indicating above average risk.

- Excellent Timing: The Relative Timing (RT) rating focuses on the price trend over the short, medium, and long term. The components include price direction, dynamics, and price magnitude of price changes over daily, weekly, quarterly, and yearly comparisons. PERI has a significantly high RT rating of 1.76 compared to the average 0.84 RT of all the stocks in the database. Also, the chart’s MACD indicator was in an uptrend until March 3, but has ticked down the last 10 days, in sympathy with the market decline.

- Very Good Comfort Index: This index measures the consistency of a stock’s long-term resistance to severe and lengthy corrections. This index compares the individual stock to the fluctuation of the VectorVest Composite price that is measured on a scale of 0 to 2.00. At a level of 1.39, PERI’s rating is solidly above average. Therefore, this stock is certainly suitable for all types of investors

- Excellent Growth Rate (GRT): PERI’s respectable 27% forecasted growth rate is measured over a forecasted three-year period. This fundamental factor is calculated in the VectorVest software, so you don’t have to do the work. The chart below highlights its up trending earnings with a consistent step-up after each earnings release.

- Excellent VST Score: The VST Master Indicator ranks 9,141 stocks from high to low and brings to the top of the rankings those stocks with the highest VST scores. PERI’s high score of 1.431 places it in the upper 2% of the entire database which is rarefied territory. Using VST enables users to identify stocks that are performing much better than average, as well as the opportunity to find the cream of the crop in all its critical criteria with a few mouse clicks. This stock is definitely in that category.

Considering the above average VectorVest scores and its positive earnings and price trends, this may be a good time to consider adding PERI to your portfolio, as it is only two days off its all-time high. First, make sure that you check out VectorVest’s overall market timing signal to make sure the trend is your friend, additional PERI stock ratings, and its buy, sell or hold recommendation before making a purchase. To see PERI’s current recommendation analyze it free using VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.