Rumors are circulating that Sony is in talks with Take-Two Interactive Software (TTWO) and hopes to acquire the company. Take-Two is more notably known for the companies it holds underneath it: 2K Games, Rockstar Games, and Visual Concepts.

These rumors were first reported by gaming websites like GameCentral and Xfire, and many brushed them off as Sony has gone on the record expressing distaste for large-scale gaming mergers like this one. But, it seems that this could be Sony’s way of keeping up with Microsoft – whose $69 billion acquisition of Activision Blizzard is still pending.

While Take-Two currently has a valuation near $20 billion, it’s believed that this figure could be higher with the right leadership and strategy in place. However, one thing is for sure – that valuation is going to change dramatically when the anxiously-awaited GTA 6 game is finally released.

All of this is to say that from Sony’s standpoint, getting a deal done with Take-Two prior to that release date is advantageous. If they’re serious about acquiring the developer, they’ll be motivated to do it sooner rather than later to capitalize on a lower valuation.

As a result of this news, which started making headlines at the beginning of March, Take-Two has jumped 4%. This comes as the company has already had an incredible start to the year and sits more than 18% higher than it ended 2022.

With that said, are these rumors and the hype around them enough to earn TTWO a spot in your portfolio? Speculation aside, there are a few things we’ve uncovered through the Vectorvest stock forecasting software that will excite investors.

TTWO Has Good Safety & Timing Right Now With Fair Upside Potential

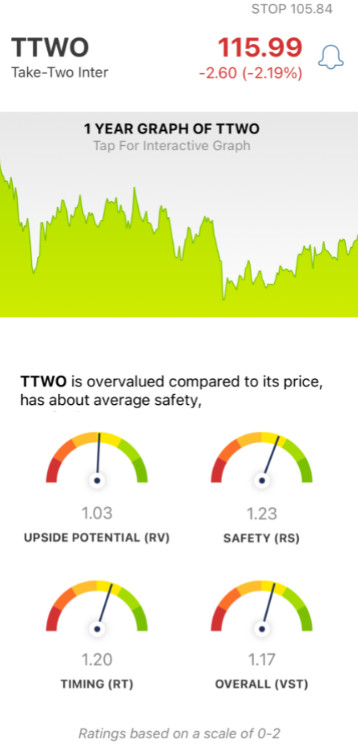

The VectorVest system transforms the way you discover and analyze opportunities in the stock market - saving you time and eliminating costly errors. You’re given all the insights you need to make a clear, calculated decision in three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy. But taking things a step further, VectorVest gives you a clear buy, sell, or hold recommendation based on the overall VST rating for a stock. Want one for TTWO? Keep reading below…

- Fair Upside Potential: In comparing this stock’s 3-year price appreciation projection to AAA corporate bond rates and risk, VectorVest deems the upside potential to be fair - as indicated by the RV rating of 1.03, which is just above the average. It’s worth noting, however, that the stock is overvalued right now - with a current value of just $91.56.

- Good Safety: The RS rating of 1.23 is good, and indicates that TTWO is a safe stock right now. This is calculated by analyzing the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Good Timing: As you can see by checking any time frame in the past few months for TTWO, it has a solid price trend pushing it in the right direction - which has earned it a good RT rating of 1.20. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

Now - all things considered, the overall VST rating for TTWO is 1.16 - which is good. But is it enough to earn this stock a spot in your portfolio? Or, should you wait a bit longer to see how the Sony rumors shake out?

Don’t play the guessing game or let emotion influence your next move - get a clear buy, sell, or hold recommendation through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TTWO, it is overvalued right now and has just fair upside potential - but the safety and timing are both good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.