We’ll shortly be emailing your free stock analysis report.

We’ll shortly be emailing your free stock analysis report.

You have used of free reports for today, and of total available.

Unlock unlimited analyses on 16,000 stocks, along with simple, daily, buy, sell or hold ratings on every stock. Sign up in seconds, cancel anytime.

The VectorVest approach to picking stocks, using our proprietary VST™ ratings.

Successful investing relies on stable, lasting returns, not on chasing big gains from trendy stock picks. Our VST™ (Value-Safety-Timing) ratings stack the odds in your favor by recommending safe, undervalued stocks on the rise—irrespective of their current popularity.

Value

Undervalued Stocks

Undervalued stocks offer lower downside risk and higher probability of achieving gains.

Safety

Safe Stocks

Safe stocks have track records of steady earnings performance. There is less risk in holding stocks of financially stable companies.

Timing

Stocks Rising in Price

Really good stocks usually take off and don’t look back. A stock rising in price is already doing what you want it to do.

How to use VST™ ratings to grow your portfolio in as little as 10 minutes a day.

Our exclusive VST™ ratings distill hundreds of data points into clear buy, sell, or hold recommendations for every stock. This makes trading impossibly simple, ideal if you’re new to investing or learning to manage your own portfolio.

- 1

Check for stocks rated a sell (more than likely your stops will get you out before this happens).

- 2

Check the market timing signal to see if you should buy stocks or tighten stops on existing positions.

- 3

If the market timing is favorable, pick stocks with the highest VST rating.

- 4

Set recommended stop prices, calculated uniquely for each stock based on its historical price movement.

If you’re a seasoned investor, or developing your skills: VectorVest offers limitless opportunities for learning, growth, and portfolio management through deep data, insights, and educational resources.

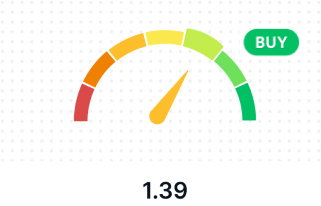

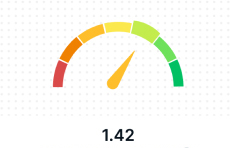

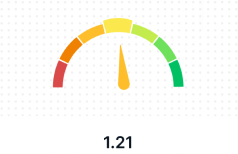

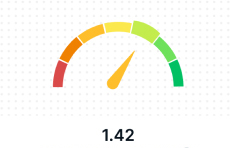

Our VST™ rating (from 0 to 2)

OVERALL

RELATIVE VALUE (RV)

RELATIVE SAFETY (RS)

RELATIVE TIMING (RT)

“I originally got this app as a “2nd opinion” brokerage app to determine if Robinhood’s stock ratings were viable or not.”I’ve made +27% in the past 4 months.

I have been using VestorVest for a number of years and am averaging 30% annual returns. VectorVest is instrumental in my success.

I’ve been with VectorVest +10 years and took their course that covers Spread Trading. The next 12 months I pocketed over $110,000 trading SPX only while risking only $20K at any one time.