Before the opening bell rings at 9:30 AM EST, there’s a hidden window of action that can set the tone for your trading day: the premarket session. Welcome to The Ultimate Guide to Premarket Movers, where we’ll unpack what these early risers (and fallers) are, why they matter, and how you can leverage them to sharpen your portfolio’s edge. Whether you’re hunting for breakout stocks or dodging volatility traps, this guide is your roadmap to mastering the premarket game.

We’ll even show you how to analyze these movers for free—up to three stocks a day—with tools designed to put you ahead of the crowd. Ready to dive in? Let’s get started.

What Are Premarket Movers?

Premarket movers are stocks that see significant price action during the premarket trading session, which runs from 4:00 AM to 9:30 AM EST. Unlike the regular trading day, this period is a quieter arena—fewer players, lower volume, but often bigger swings. These movers can be gainers climbing on fresh news or losers tumbling before the market fully wakes up. Think of them as the market’s opening whispers, hinting at what’s to come when the bell rings.

So, what sparks these early shifts? It’s usually a mix of:

- Earnings Reports: Companies dropping results after hours can send stocks soaring or sinking.

- Breaking News: Mergers, product launches, or geopolitical events can jolt prices.

- Analyst Upgrades/Downgrades: Wall Street’s morning opinions often sway sentiment.

- Retail Buzz: Social media chatter can amplify moves before institutional traders clock in.

For self-directed investors, premarket movers are like a crystal ball—if you know how to read them. But here’s the kicker: spotting them is one thing; acting on them is another. That’s where preparation meets opportunity.

Quick Tip: Curious about a stock’s potential? Get a free stock analysis to see what’s driving its early moves—no guesswork required. Click here to analyze your first stock now.

Why Premarket Trading Matters

You might be wondering, “Why bother with premarket when I can just trade at market open?” Fair question. The truth is, the premarket session isn’t just noise—it’s a goldmine for savvy investors willing to dig. Here’s why it’s worth your attention:

- First-Mover Advantage: Stocks that gap up or down premarket often set the day’s trend. Catching a mover early could mean buying low before a rally or sidestepping a dud before it tanks.

- Volatility Play: Lower volume means wider spreads and bigger swings—perfect for short-term traders who thrive on momentum.

- News Reaction Time: Premarket lets you process overnight developments and position yourself before the herd rushes in.

- Portfolio Protection: Seeing a stock drop premarket? You can plan your exit or double down with confidence.

Take NVIDIA (NVDA) as an example. After a stellar earnings beat in late 2024, its stock jumped 8% premarket, signaling a bullish day ahead. Investors who spotted that move early locked in gains while others scrambled at the open. That’s the power of premarket awareness—it’s not just about trading; it’s about staying one step ahead.

But here’s the catch: premarket isn’t for the faint of heart. Thin liquidity can exaggerate moves, and not every spike sticks. So, how do you separate signal from noise? It starts with the right tools—and a strategy to match.

Top Tools for Tracking Premarket Movers

Self-directed investing is all about empowerment, and that means having the best tools in your arsenal. Tracking premarket movers doesn’t have to be a guessing game—here’s what you need to stay in the know:

- Real-Time Scanners: Tools like VectorVest’s RealTime Derby bring premarket scanning to life, pinpointing stocks with unusual volume or price action before the bell. This revolutionary feature runs over 100 strategies in real time, delivering top-performing stocks at a glance—no more sifting through endless tickers.

- News Aggregators: Sites like Yahoo Finance or Bloomberg can clue you into catalysts, but speed is key—pair them with a tool that ties news to price action.

- Broker Platforms: Many brokers (e.g., TD Ameritrade, E*TRADE) show premarket data, but they often lack deeper analysis. You’ll want more than just a price ticker.

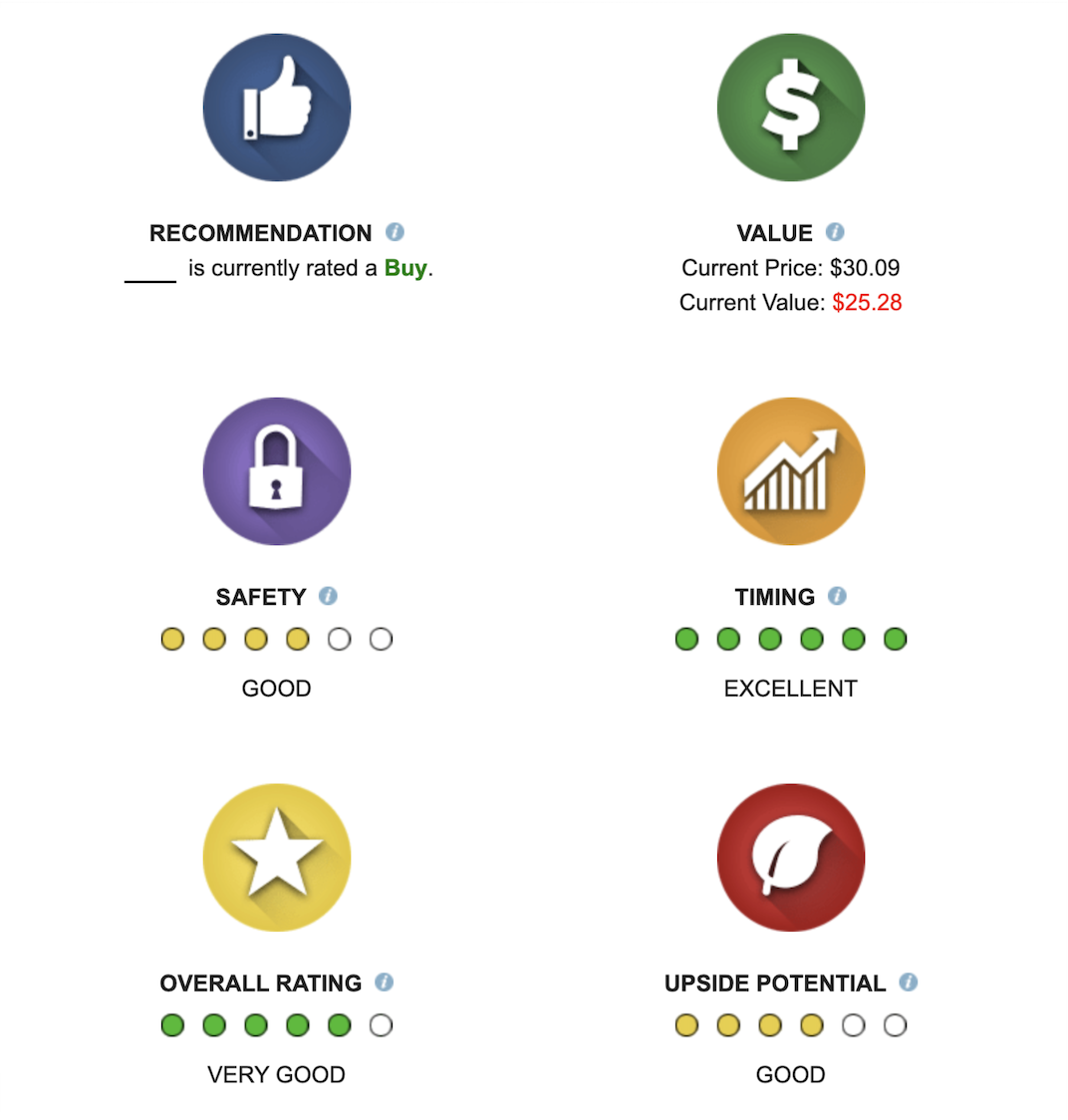

- VectorVest’s Edge: Why settle for basic? VectorVest not only tracks premarket movers but rates them with proprietary Buy, Sell, or Hold signals—based on Value, Safety, and Timing (VST). Paired with RealTime Derby, which tracks mini-portfolios of top stocks from open to close, it’s like having a market whisperer in your pocket.

Here’s a thought-provoking twist: the best investors don’t just find movers—they understand them. A stock up 10% premarket might look tempting, but is it overbought? Is the volume sustainable? Tools like VectorVest dig into the fundamental and technical patterns giving you clarity amid the chaos.

Try This: Pick a stock you’re eyeing and run a free stock analysis with VectorVest—. See what’s moving it premarket and decide your next play. Get your free analysis here.

Strategies to Understand Premarket Moves

Now that you’ve got the tools, let’s explore how to make sense of premarket movers. This isn’t about jumping on every flicker of activity—it’s about building a framework to analyze what’s happening before the bell. Here are four concepts self-directed investors can consider to decode early market signals and align them with their goals. Note: These are general approaches for educational purposes only, not personalized advice. Always conduct your own research and assess your risk tolerance before acting.

1. Identifying Potential Breakouts

- What to Look For: Stocks gapping up premarket, often tied to catalysts like earnings surprises or major news, with notable volume behind them.

- How to Analyze: Watch for technical levels, like a break past a 52-week high, and use tools like VectorVest’s VST rating to gauge the stock’s overall strength—combining Value, Safety, and Timing into one snapshot.

- Example: Imagine a biotech stock surges 15% premarket after FDA approval. High volume might hint at momentum, but you’d want to assess if it’s sustainable past the open by looking at the stock’s historical performance—your call based on your strategy.

2. Spotting Overhyped Movers

- What to Look For: Stocks spiking with little substance—think low volume or social media hype that might not hold up.

- How to Analyze: Check indicators like Relative Strength Index (RSI) (above 70 could signal overbought conditions) or VectorVest’s Stock Safety metric to evaluate stability and potential risks. Thin volume might suggest a fade ahead.

- Example: A meme stock rockets 20% premarket on X chatter but lacks depth. You might see it as a chance to study volatility—or a red flag to watch from the sidelines.

3. Analyzing Premarket Gaps

- What to Look For: Stocks that gap up or down premarket, creating a price disconnect from the prior close.

- How to Analyze: Historical patterns can show if gaps tend to fill during regular hours. VectorVest’s Stock Timing indicator offers insights into market momentum, helping you frame the context—not dictate your move.

- Example: A stock drops 5% premarket after a downgrade. If past gaps suggest a rebound, you might explore it further—but past performance isn’t a promise, so dig deeper.

4. Building a Premarket Watchlist

- What to Look For: Stocks showing early action that could signal longer-term potential, without rushing to act.

- How to Analyze: Use VectorVest to tag movers, then dive into their fundamentals—earnings, growth, stability—to see if they fit your portfolio later. Patience can be your edge.

- Example: A mid-cap stock climbs 7% premarket. Add it to your watchlist in VectorVest, monitor its trends, and decide if it’s worth a closer look when the dust settles.

Your Next Move: Analyzing premarket movers is about asking the right questions, not following a script. Premarket trading isn’t mandatory—sometimes the smartest move is waiting for confirmation at the open. But when you do jump in, precision matters. VectorVest’s real-time insights can cut through the noise, so you’re not just reacting—you’re strategizing.

Take Control of Your Premarket Edge

The premarket session is your chance to outpace the market—to see what others miss and act before the crowd catches on. But it’s not about luck; it’s about tools, timing, and a willingness to dig deeper. As a self-directed investor, you’ve got the drive—now equip yourself with the resources to match.

Here’s your next step: analyze those premarket movers for yourself. With VectorVest, you can get a free stock analysis——to uncover what’s driving the action. See a stock spiking premarket? Plug it in, get the full picture, and decide your move. Click here to get your free analysis now.

Better yet, why stop there? Take VectorVest for a test drive with a trial and unlock real-time scanning, VST ratings, and more. It’s the toolkit self-directed investors trust to turn early opportunities into lasting gains. Ready to elevate your portfolio? Start your trial today.

The bell’s about to ring—will you be ready?

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment