After the market closed yesterday, C3.ai (AI) reported fiscal 4th quarter earnings. The company exceeded analyst estimates for revenue and profit alike – and yet, the stock fell off a cliff.

Revenue of $72.4 million came in well above the $71 million estimation from Wall Street. And while the company still reported a negative EPS, it was a narrower loss than anticipated. Experts were projecting a $0.17 loss, while the company reported a loss of just $0.13.

The company is performing better than expected…so why is it down more than 12% so far the morning after the earnings release? The full-year revenue outlook the company laid out came in under analyst expectations.

The company is looking for a revenue figure between $295-$320 million, whereas Wall Street was expecting at least $321 million. This narrow margin has spoiled the party and put a damper on what was otherwise a great earnings day for C3.ai.

The company stated that they’ve always led the charge in the enterprise AI market, from the early days of IoT, to unsupervised learning, supervised learning, NLP, deep learning, and reinforcement learning. Nothing is changing now as the world steps into generative AI. Still, the vibe throughout the market is that this is a miss for C3.ai.

Simply put, C3.ai is not Nvidia. And yet, the market expects them to contend Wall Street’s latest darling company. After Nvidia raised their guidance for the remainder of the year dramatically, the weakened outlook of C3.ai has left experts and investors underwhelmed.

Now, is it fair to say that C3.ai is actually failing to capitalize on the AI boom? Or, is this yet another example of market sentiment creating a narrative? We’re going to help you tune out the noise and just look at AI through VectorVest’s unbiased, tried-and-true stock analysis system. There are 3 things you need to know about this stock…

Despite Poor Safety and Very Poor Upside Potential, AI Still Has Excellent Timing After This Small Step Backwards

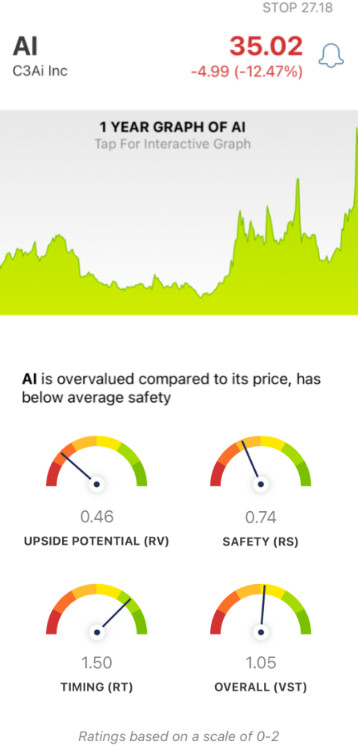

The VectorVest system simplifies your trading strategy by giving you all the insights you need in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. And, based on the overall VST rating for a given stock, VectorVest issues a clear buy, sell, or hold recommendation - at any given time. No more guessing games, no more emotional investing. Just follow the system to win more trades with less work! As for AI, here’s what you need to see:

- Very Poor Upside Potential: The biggest issue for AI right now is the very poor RV rating of 0.46. This rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. Making matters worse, the stock is overvalued - with a current value of just $7.60.

- Poor Safety: In terms of risk, AI has poor safety as well. The RS rating of 0.74 is derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing AI has going for it, though, is an excellent RT rating of 1.50 - suggesting the positive price trend that had been forming for stock is still strong. While it took a step back today, it’s still up nearly 22% in the past week and a whopping 252% since the start of the year. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All this said, the overall VST rating is fair at 1.05 - just above the average. Does that mean it’s still worth adding AI to your portfolio - is this a good dip to buy in at? Or, is it a sign of what’s to come? Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for AI, it took a step back today after yesterday’s earnings report - but the stock still has excellent timing. With that said, the stock has very poor upside potential along with poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment