Spectrum Brands released a statement early Friday morning expressing confidence that the sale of their HHI (hardware & home improvement) segment will go through after all. This is a story that’s been in the making since September 2021. And today, Spectrum Brands stock (SPB) is up over 22% as a result.

The company has been trying to iron out a deal with ASSA ABLOY group – a Swedish conglomerate – to purchase Spectrum Brand’s HHI segment for a whopping $4.3 billion cash. This deal was agreed to back on September 8 of last year before being promptly shut down by the US Department of Justice a mere 7 days later.

The concern by the US DOJ was competition. They created what many deem to be a meritless lawsuit to block the transaction. However, it appears the door has opened once again as the two companies have found a way to ease these concerns.

ASSA ABLOY will sell its Emtek and Smart Residential Business in the US and Canada to Fortune Brands to appease the DOJ, while also making room for the new addition to their roster in Spectrum Brands’ HHI.

According to the CEO of Spectrum Brands – David Maura – this is an acquisition that results in a win for all parties – most of all, consumers. The HHI business is better suited in the hands of ASSA ABLOY, as they’re equipped to handle the fierce competition of the US security market. Maura believes this will result in innovation that grants consumers access to superior products.

Maura finished his statement by expressing that Spectrum Brands continues to strongly disagree with DOJ concerns. Nevertheless, he is confident that the solution all parties put in place will leave the DOJ with no argument – and that the sale will go through in the end. In fact, he expects the sale to be finalized no later than the second quarter of 2023.

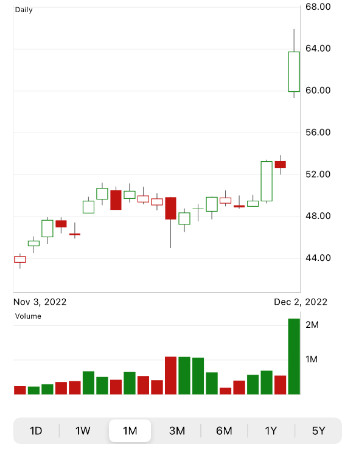

This news sent the stock up 22% so far Friday morning – and this is strengthening the price trend we’ve witnessed forming over the past 3 months. So – what should your next move with Spectrum Brands be? Is there still room to buy at a favorable price after today’s spike? Or – is it still too early to tell if this deal is actually going to go through?

We can help you tune out the noise and make a decision based purely on tried-and-true stock analysis. In fact, we’ve identified two major red flags you should be aware of by analyzing the stock through the VectorVest stock analysis software.

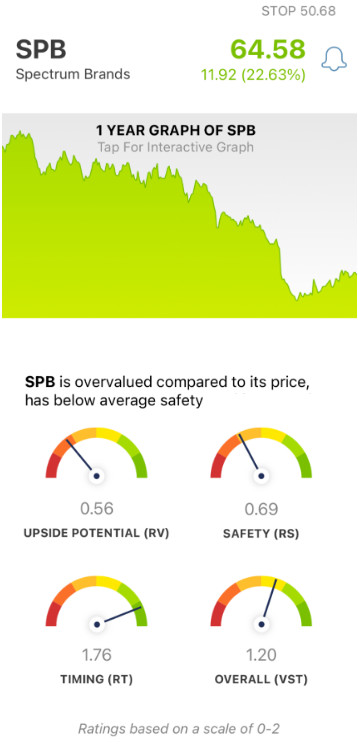

Although SPB Has Excellent Timing, Upside Potential & Safety are Poor

The VectorVest system simplifies stock analysis by telling you everything you need to know about a stock in just three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). Interpreting these ratings is as straightforward as it gets. They sit on a simple scale of 0.00-2.00 – with 1.00 being the average. Stocks with ratings over 1.00 are overperforming, and vice versa.

And, the real reason to invest using VectorVest is that based on these three ratings, you’re given a clear buy, sell, or hold recommendation for any given stock, at any given time – and yes, that includes SPB! Here’s the current situation:

- Poor Upside Potential: In taking a look at the long-term price appreciation potential for SPB through VectorVest, you’ll discover that the upside potential is poor – with an RV rating of 0.56. In fact, the stock is overvalued at the current price – with the current value of just $26.81.

- Poor Safety: An indicator of risk, the relative safety rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for SPB, the RS rating of 0.69 is poor.

- Excellent Timing: This is where things get interesting – as there is no denying the excellent timing behind SPB’s price trend. The RT rating of 1.76 reflects that. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

Combine them all into a singular Value, Safety, & Timing metric (VST) and SPB has a good rating of 1.20. Now – the question is, does the excellent timing right now outweigh the poor upside potential and safety – or vice versa?

This play is very dependent on timing, so if you do decide to buy SPB you’ll need to stay up to date on the RT rating in order to exit your position at the right time. That’s something VectorVest can help you with – get a clear recommendation on your next move with a free stock analysis here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SPB, it is overvalued with poor upside potential & poor safety – but it has excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment