Roblox (RBLX) shares made quite the jump in Tuesday morning trading after a favorable update in December. The stock is up 12% as of 11:30 AM EST – but what has analysts and investors so excited about this stock?

This stock’s movement is largely due to an increase in “bookings” – which is the figure Roblox uses in place of revenue. And to understand why bookings are up, you need to know what Roblox is.

This is an online game platform that allows users to play an array of games – and even create games of their own. The platform is entirely free – but users are able to purchase “Robux”, a virtual currency within the game. This currency can be used to customize your player and access other premium features. That’s where revenue comes from for the company.

And in the month of December 2022, bookings were up between 17%-20% year over year. This will come in at around $430-$439 million. This increase can be attributed mainly to an increase in active daily users – which is also up about 18% from the same period last year.

This was an important turnaround for Roblox after a grave update in the month prior. November saw slow growth and a decline in bookings per daily user. And, it appears a positive price trend is forming for the stock. In the past month, shares are up 35%. This is great to see for Roblox investors, who have suffered through a tough last year as the stock sits 53% lower in the past 365-day period.

Will this trend continue? Is now a good time to buy RBLX stock? Through the VectorVest stock analysis software, we’ll show you three key considerations to weigh before making your move.

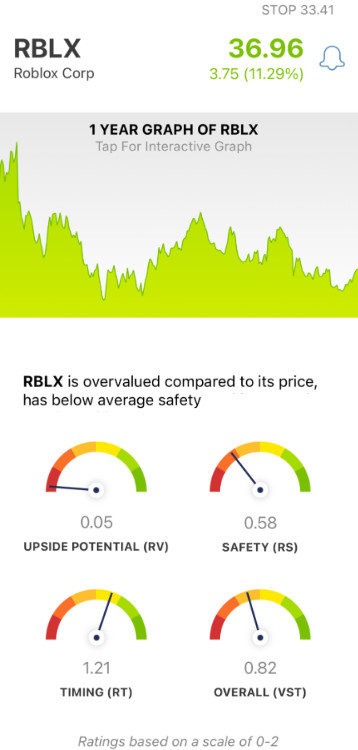

RBLX Has Very Poor Upside Potential, Poor Safety, and Good Timing

The VectorVest system transforms your approach to investing by simplifying everything for you. No longer are you forced to track countless technical indicators or make decisions based on emotion or guesswork.

Instead, you can make confident decisions based on three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 – with 1.00 being the average. By picking stocks over the average, you can set yourself up to win more trades.

Better yet, the system provides you with a clear buy, sell, or hold recommendation based on these ratings. As for RBLX, here’s what you need to know before you make your next move:

- Very Poor Upside Potential: The RV rating of 0.05 is very poor for RBLX. This is calculated based on the stock’s long-term price appreciation potential compared to AAA corporate bond rates and risk. Moreover, the stock is overvalued at its current price. The current value is just $2.87.

- Poor Safety: An indicator of risk, the RS rating is based on a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. And right now, the RS rating of 0.58 is poor.

- Good Timing: The one thing RBLX has going for it right now is the price trend we’ve seen form over the last month or so – and a good RT rating of 1.21 reflects that. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All this considered, the overall VST rating for RBLX is poor at 0.82. So what does that mean for investors who currently have positions in RBLX – is it time to sell? Or, if you’re wondering if now is a good opportunity to enter at a great value – is now the time to buy?

You’re going to want to see the recommendation VectorVest has for you – get a free stock analysis here to find out what your next move should be!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for RBLX, it is overvalued with very poor upside potential, poor safety, and good timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment