PepsiCo, Inc. reported its fourth quarter and full-year earnings on Thursday, causing shares to increase over 1% to $176.20 a share because of stronger-than-expected performance. Although investors seem pleased with the higher prices of PepsiCo’s snacks and beverages, this might not be a sign of good times to come.

Despite the impressive top-line results, Pepsi has seen its sales volume drop by 2% in the food business worldwide. This means consumers pay more for PepsiCo’s products without necessarily consuming more, which can negatively affect the company’s bottom line as prices stabilize.

Although there’s positive investor sentiment in the short term, Pepsi isn’t seeing the same revenue growth as it’s seen in the past. This could indicate that investor sentiment may not remain strong for an extended period as consumers continue to shift their preferences away from traditional snack and beverage products like those offered by PepsiCo.

Compared to the fourth quarter of 2021, the company’s earnings per share fell from $1.32 billion to $518 million year-over-year – a 61% decline. This dramatic drop in quarterly profits is likely due to the write-down of some of PepsiCo’s brands, including SodaStream and Pioneer Foods, as well as higher interest rates.

Consumers are susceptible to price increases and seek more value in their purchases. To remain competitive, PepsiCo must find a way to deliver more value to its customers while still delivering profit growth and returns for investors. Analysts, however, are certain that non-alcoholic beverage product demand will grow, offsetting the slowdown in price increases.

One of the reasons for positive investor sentiment is that Pepsi announced that most price increases have already occurred, and they plan to take a less aggressive stance on pricing increases in the future. Although Quaker Foods and Pepsi’s North American distribution divisions were hit by volume drops, Pepsi Zero Sugar saw its volume climb 26%, indicating that it can still meet customer demand.

Other products within PepsiCo’s North American beverages unit also showed strong growth, with organic revenue growth of 10%, while average prices, which delivered a majority of Pepsi’s quarterly profits, increased by 16%. Whether that can offset the 2% decline in volume remains to be seen, as annual earnings might not keep up the performance of the American market.

While PepsiCo is one company investors expect to pay dividends in the future, investors should pay close attention to their quarterly reports and understand the underlying factors affecting the company’s success. PepsiCo’s 10% dividend increase shows confidence in its products. However, with their dividend yield well below that of the top 25% of beverage market payers, investors should be aware of the risk factor in their dividend payments. Additionally, company cash flow is not currently covering the dividend payments, meaning shareholders should be prepared for a possible cut in the future.

At a current price per share of $176.20, it’s definitely time to consider the risks and rewards of investing in PepsiCo. With its diverse portfolio of products, the company has a strong foothold in both the food and beverage markets.

Yet, investors should weigh their options carefully before investing, as past quarterly performance might not indicate future successes. Given these financial reports, let’s look at the PEP stock through VectorVest reports and identify whether investing in PepsiCo is the right decision today.

Is it the Right Time to Invest in PepsiCo? Here's Why It Might Not Be Your First Choice

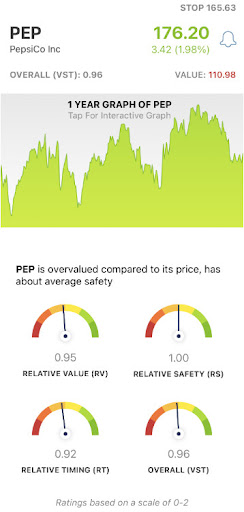

The VectorVest system changes the way you trade for the better. It tells you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Gaining insights from these ratings is fast and straightforward, as they sit on a simple scale of 0.00-2.00. Pick stocks with ratings above the average of 1.00 and win more trades!

Making things even easier, the VectorVest system provides you with a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotion clouding your judgment. As for PEP, here’s the current situation:

- Fair Upside Potential: While analysts believe that things will pick up for PepsiCo in the foreseeable future, the stock’s RV rating of 0.95 suggests that it might not provide a strong long-term price appreciation potential compared to other stocks in the market. Additionally, the stock is currently overvalued, according to VectorVest, with a price of $176.20 but a current value of $110.98.

- Fair Safety: Investors typically go for stocks with high safety ratings, as their returns are more consistent over time. As for PEP, its RS rating of 1.00 is just average, meaning that its risk profile is not significantly different from any other market stock. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: With a below-average RT rating of 0.92, PEP stock’s short-term price trend is fair, according to VectorVest. This means that the stock may be able to hold its ground in the near future but is not likely to gain any more significant upside. This rating is calculated based on the trend’s direction, dynamics, and magnitude. It’s analyzed day over day, week over week, quarter over quarter, and year over year so you have the full viewpoint.

Together, these metrics total a combined VST rating of 0.96 - which is fair but slightly below the 1.00 average. Does it earn PEP a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell, or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for PEP, it is overvalued with fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment