Nvidia (NVDA) is expected to report its fiscal fourth-quarter earnings on Wednesday, February 22nd (tomorrow) – and the consensus is that the company is going to disappoint once again. However, there is one thing that has experts and investors alike excited when it comes to Nvidia – AI.

Over the last year or so, Nvidia has struggled with many of the same challenges other semiconductor manufacturers faced. Problematic economic headwinds affecting consumer demand, China’s COVID-19 restrictions affecting supply, rising interest rates, and more.

All of this is going to result in a letdown for Wednesday’s earnings report. The company is expected to report 4th quarter earnings per share of $0.81 – down from $1.32/share a year earlier. Revenue is expected to take a hit of 21%, too.

However, it’s very likely that the upbeat outlook Nvidia will report for 2023 is going to wash away the negative earnings report. In fact, Wall Street is projecting a 9% growth in revenue for this company in the new fiscal year – which will be fueled by AI.

While Nvidia has been manufacturing chips for the past three decades, the business is at an inflection point – and they’re taking advantage of the opportunity to rethink how their GPUs are used. Just last November Microsoft and Nvidia teamed up to build a supercomputer to train, deploy, and scale AI.

Many still have doubts as to the true potential of products like ChatGPT beyond their novelty use cases, the hype around AI right now is all that matters from a stock market sentiment standpoint.

So – is this a good opportunity to buy NVDA as it’s dropped 7% in the last week? Or, should you wait to see what actually happens with earnings before making a decision? We’ll analyze this opportunity through the VectorVest stock forecasting software below to help you find a clear answer on your next move.

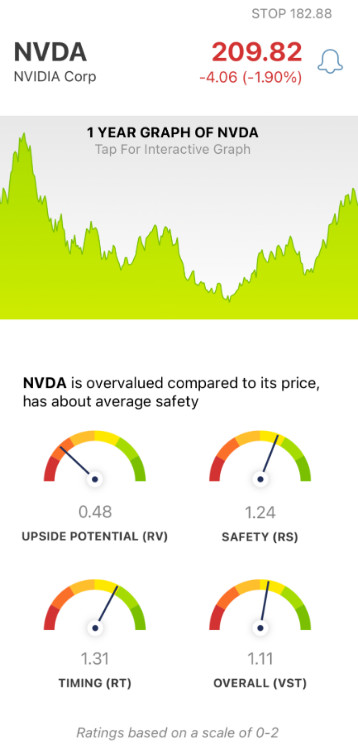

NVDA Has Very Poor Upside Potential, But Good Safety & Very Good Timing...

The VectorVest software tells you everything you need to know about an opportunity in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings above the average indicate overperformance in a given category and vice versa.

But, to really simplify your trading strategy and eliminate guesswork/emotion, VectorVest uses the overall VST rating for a stock to give you a clear buy, sell, or hold recommendation. As for NVDA, here’s what you need to know before making your next move:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (three years out) to AAA corporate bond rates and risk. And right now, the RV rating of 0.48 is very poor. What’s more, the stock is way overvalued - with a current value of just $54.33.

- Good Safety: Taking a look at risk, VectorVest has a good RS rating of 1.24. This is calculated from the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: In the past month, NVDA is up 37% - and while this price trend has subsided over the last week, the timing is still very good, earning this stock an RT rating of 1.31. This is based on the direction, dynamics, and magnitude of the stock’s price movement. VectorVest takes this rating day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.11 is good for NVDA - but is it enough to earn a “buy” recommendation? You don’t have to play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with NVDA through a free stock analysis today. You’re not going to want to miss this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks, and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell, or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, NVDA has very poor upside potential. However, the stock does have good safety and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action.

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment