Last week Moderna (MRNA) announced a licensing deal with Generation Bio that they hope will allow them to overcome the losses they’re facing now that the COVID-19 pandemic has come and gone. And as a result of this deal, Generation Bio (GBIO) gained 34% in the past week of trading.

The partnership will have Generation Bio developing treatments for Moderna that target the immune system and liver. Moderna will also now have access to Generation Bio’s proprietary drug delivery system and DNA technology as a result of this deal.

The specifics of the deal have earned Generation Bio a $40 million cash payment upfront followed by a $36 million equity investment. And that’s just the guaranteed payout from Moderna’s end. Should the treatments made by Generation Bio achieve certain development, regulatory, and/or sales milestones, an additional $1.8 billion in payments could be sent their way.

The initial news sent shares more than 13% higher, but that momentum hasn’t slowed down since then. It’s a new week, and Generation Bio is still up nearly 2% in Tuesday’s trading session.

If the company is able to hit a home run and earn a potential 10-figure payout for one of the drugs they develop, buying in now at a mere $5.22/share could end up being a steal for investors. Or, if you’re currently invested in GBIO, you may be wondering – is this a way to get out of a stock that’s down 20% in the past year and earn a solid profit?

You don’t have to play the guessing game or let emotion influence your next move. We’ll take a look at three key ratings you need to understand before making a decision one way or the other below. Here’s what the VectorVest stock analysis software has to say about GBIO right now…

Despite Fair Timing, GBIO Still Has Poor Upside Potential & Safety

The VectorVest system simplifies your trading strategy, helping you win more trades with less work and stress. It’s all possible through the proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it.

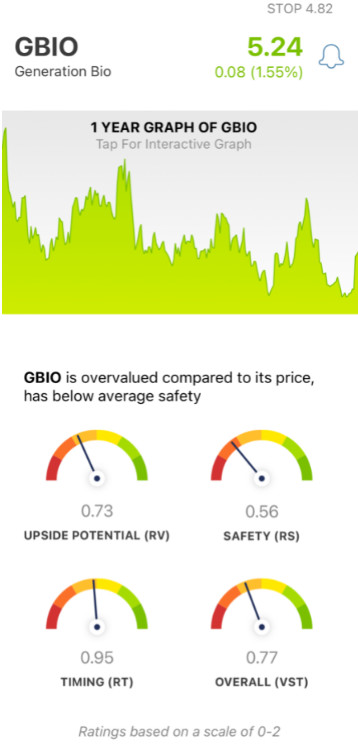

In just three simple ratings, you’re given all the insights you need to make an informed decision with confidence. These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average.

By picking stocks with ratings above the average, you can win more trades. But it gets even easier - as you’re given a clear buy, sell, or hold recommendation based on these ratings for any given stock, at any given time! Right now, here’s what the system has to say about GBIO:

- Poor Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential (three years out) compared to AAA corporate bond rates and risk. And even after this deal, the RV rating of 0.73 is poor. Moreover, the stock is currently overvalued by a slight margin.

- Poor Safety: Moreover, the stock has a poor RS rating of 0.56. This rating is based on the company’s financial consistency & predictability along with its debt-to-equity ratio and business longevity.

- Fair Timing: The one thing that this stock has going for it right now is a positive price trend forming and taking hold. Even still, though, the RT rating of 0.95 is just fair - and just below the average. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of GBIO is poor at 0.77. So - does that mean it’s actually time to sell this stock? Or, should you hold a bit longer to see how the price trend we’re seeing form real-time performs in the coming days/weeks? Get a clear answer on your next move with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for GBIO, it still has poor upside potential and safety even after the Moderna deal. And despite the movement we’ve seen over the past week, the timing is still just fair.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment