It’s been a tough week for Google as far as the news goes. Headlines about lawsuits and software crashes, and even a riff with another tech-giant Apple for texting standards are all making noise. As you can imagine, this news has investors scrambling – but, our system still rates Google a buy. There are 4 reasons why – and we’ll explain them in-depth for you below. First, let’s take a look at what the fuss is all about.

The Department of Justice is on the brink of finalizing years of work preparing a lawsuit against Google. The claim is that Google has created a monopoly in the digital advertising market. The DOJ’s antitrust division is – according to those close to the situation – going to be ready to sue Google as early as September of this year. While Google does make up the largest portion of the U.S. digital advertising spending at 28.6%, they’re not too far ahead of Facebook – a company that sits at 23.8%. And, this isn’t the first time the DOJ has aimed its sights at Google – they sued the tech company back in 2020 for similar reasons.

More recently, Google had to issue an apology as their software update caused a major international outage Tuesday afternoon. This caused problems not just with search – but in Gmail, Google Images, Google Maps, and other sister platforms. This caused a huge uptick in users resorting to alternatives for the afternoon – Bing and DuckDuckGo.

Tune Out the Noise – 4 Reasons Google is Rated a Buy in VectorVest’s System

These negative headlines raise concern among investors about their positions in Google – especially ahead of the pending DOJ lawsuit. Is this concern substantiated? At VectorVest, we believe in trading without emotion – and our system helps you do just that by relying on sound stock analysis principles and innovative rating systems. There are four reasons why VectorVest still rates Google a buy – despite the negative press.

- It’s Slightly Undervalued: a huge principle behind our investing strategy at VectorVest is to buy undervalued stocks with ample momentum pushing their price up. While Google’s current price is $120, we value it higher – at $130. While the difference between value and reality isn’t much, it’s a positive signal nonetheless.

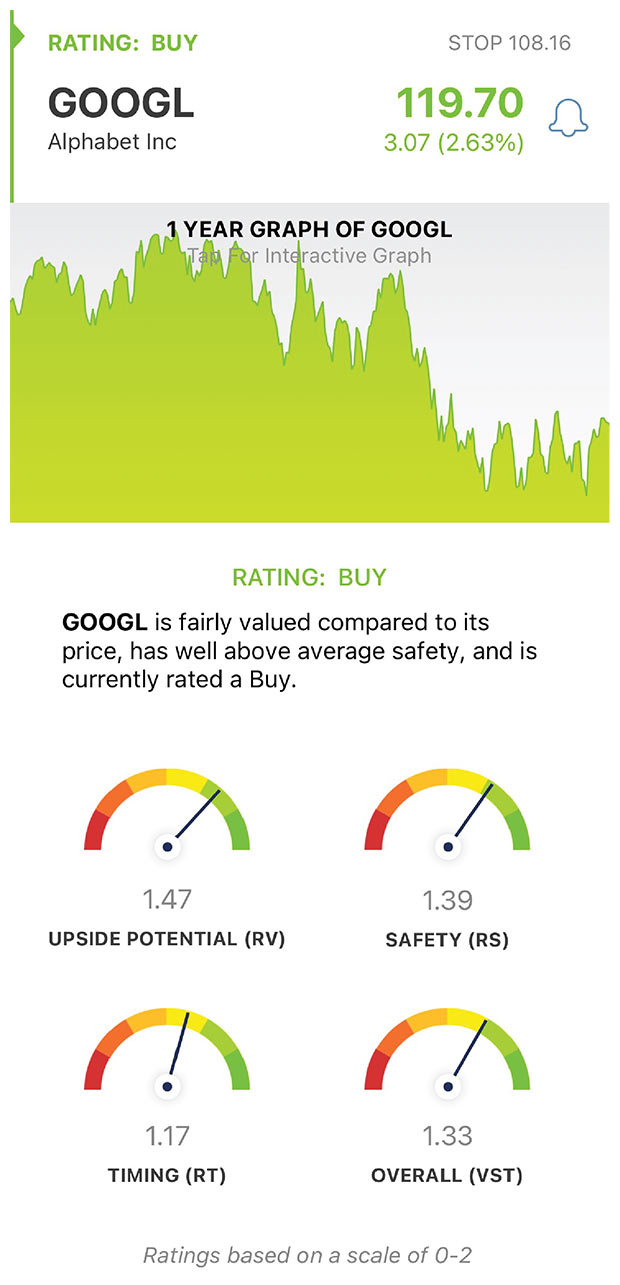

- Google’s Upside Potential is Pretty Strong: Our RV (Relative Value) rating is an indicator of long-term price appreciation potential. And on a scale of 0.00-2.00, we’ve rated Google’s RV a 1.47 – far above average.

- Forecasted Earnings Growth Rate is Excellent: Another metric we rely on to assess the potential of company stock in the future is the forecasted earnings growth rate. Over the next three years, Google has a forecasted earnings growth rate of 25% – which is excellent.

- It’s Relatively Safe: Similar to RV, RS (relative safety) sits on a scale of 0.00-2.00 – and currently, Google sits at 1.39 – which indicates the stock is relatively safe. This rating assesses risk through an analysis of the consistency and predictability of a company’s financial performance – along with business longevity, price volatility, sales volume, and more.

Taking these four factors into account – along with many others – our stock analysis system have rated VectorVest a buy with a VST (Value, Safety, Timing) rating of 1.33 – which is very good on a scale of 0.00-2.00. This is despite a negative news cycle and a below-average comfort index (CI).

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Google, it is safe, it shows great long-term upside potential, and the timing is good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment