So far this morning, Coinbase is up over 7% as a result of their latest news. It appears the cryptocurrency wallet has struck a deal with Google. This will allow Google’s customers to pay for their cloud services through cryptocurrency starting next year. And this deal is not just about crypto and payment – as it will result in Coinbase shifting away from Amazon Web Services Cloud to Google’s.

From Coinbase’s standpoint, this deal satisfies one of its primary objectives in the near term: diversifying revenue. The vast majority of their revenue (over 90%, in fact) comes from trading fees. And in a time when crypto trading is down amidst recession fears and poor performance, the crypto wallet has certainly struggled.

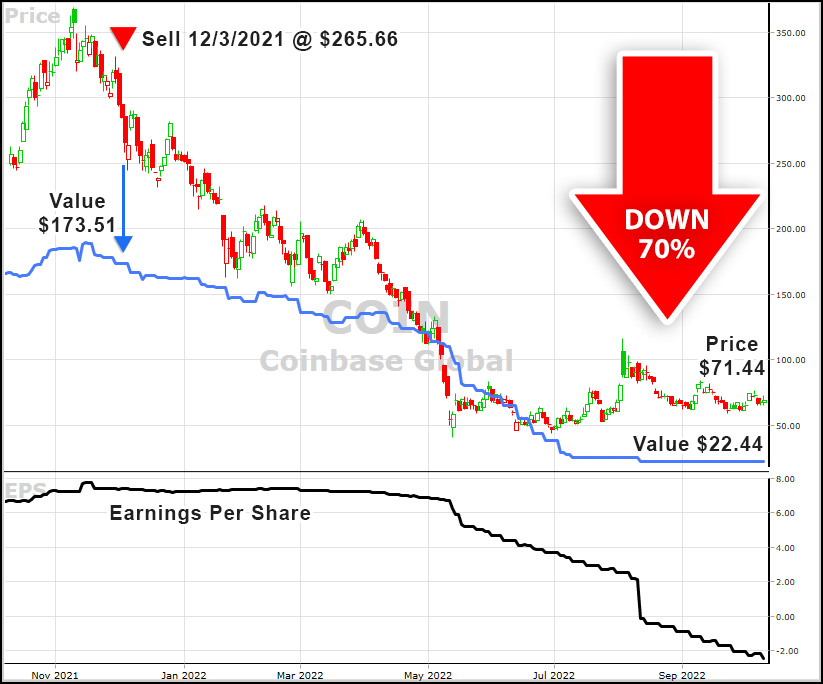

The stock market as a whole has had a rough year – but crypto in particular has been hit hard. Coinbase is down over 70% in the past year. And last week, the stock took another steep 7% dip overnight – but the latest news has more than recovered this loss.

From Google’s standpoint, the shift towards cryptocurrency has been long awaited. They’ve been an active investor in cryptocurrency since 2017. Moreover, they’ve stated that they’re expanding their own blockchain offerings with the formation of a dedicated task unit.

The manner in which this deal will positively impact both companies remains to be seen. However, Coinbase investors should certainly tune in to the company’s third-quarter earnings report on November 3, 2022. Not only will information about the implications of this deal be released, but shareholders will be able to submit/upvote questions for executives to answer on the call.

With all this said, is now a good time to buy Coinbase? This deal could be a turning point for the crypto exchange. On the other hand, it could just be another bump along a long-term downward trajectory. If you want a recommendation on your next move with COIN from a tried-and-true form of stock analysis, keep reading down below.

Despite the Google Deal, There are 3 Major Issues With COIN Stock

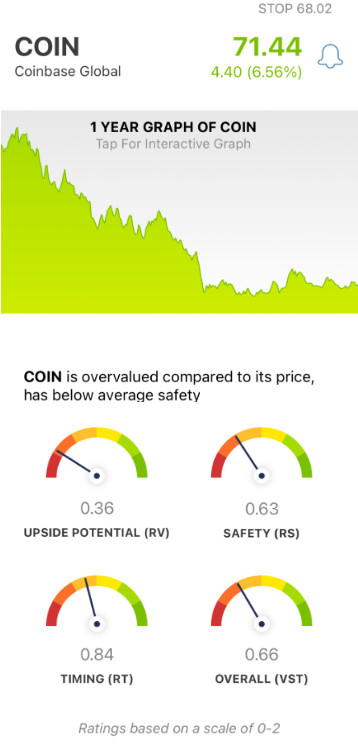

The VectorVest stock market analysis software helps investors simplify trading through three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00. The closer to 2.00, the better stock is performing in a given category. 1.00 is the average.

And based on these three ratings, the VectorVest system can provide investors with an overall VST rating – along with a clear buy, sell, or hold recommendation. You’ll never have to play the guessing game or let emotion influence your decision-making again. As for COIN, here’s the current situation:

- Very Poor Upside Potential: RV is an indicator of long-term price appreciation potential. It’s calculated up to three years out so you can zoom out and get an understanding of “the big picture”. As for COIN, the RV rating of 0.36 is very poor on a scale of 0.00-2.00. Moreover, the stock is overvalued. VectorVest calculates the current value to be just $22.44, compared to a current price of $71.83.

- Poor Safety: The system calculates RS based on risk factors like financial consistency and predictability, business longevity, debt-to-equity ratio, and more. All of these add up to an overall RS rating of 0.63 for COIN – which is poor.

- Fair Timing: Relative timing is calculated based on the direction, dynamics, and magnitude of a stock’s price trend in the short, mid, and long term. While the RT rating of 0.84 is just fair for COIN, it does appear to be gravitating in the right direction. Should it continue and pass across 1.00, it will validate that the price trend we’ve seen start to take hold this morning. However, if the RT rating loses momentum or heads back the other way, it will suggest the price trend has reversed.

All of these ratings add up to an overall VST rating of 0.66 – which is poor. However, that doesn’t necessarily mean it’s time to sell – you’re going to want to analyze the stock free here to get a clear answer on your next move with COIN. You don’t want to miss this one…

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for COIN, it is overvalued with very poor upside potential and poor safety. While the timing isn’t quite right yet, it does appear to be headed in the right direction – so keep your eye on the RT rating to pass over 1.00.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment