Coca-Cola (KO) reported solid 4th quarter earnings yesterday along with an updated 2023 outlook that should have investors (or potential investors) excited.

The company saw a 7% increase in revenue during the 4th quarter – up to $10.13 billion. This beat analyst estimates of $10 billion. This was largely driven by an increase in organic revenue performance – with a 12% growth in price/mix and a 2% growth in concentrate sales.

EPS fell flat, coming in at the same level as this period last year – and matching analyst expectations.

But, what’s even more exciting is the road ahead for Coca-Cola. The company is expecting a dramatic EPS growth rating of 4%-5% – ahead of the 2.8% consensus laid out by FactSet.

Now, when looking at both the earnings report along with the outlook for the year ahead, things look optimistic – so what caused the stock to start trending in the wrong direction?

It was the drop in profit that Coca-Cola experienced during the 4th quarter. The company’s net income dropped substantially from the same period last year when it reported $2.41 billion (56 cents a share). This year, net income was just $2.03 billion (47 cents a share). This was a 16% drop – and is cause for concern.

With that said, KO stock only fell about 1% while the market as a whole slid between 0.5%-0.7%. So, the performance of KO stock could be attributed to other factors beyond their control.

And for investors (or potential investors) wondering what this news means for them and their portfolio, we’re going to analyze the stock through the VectorVest stock forecasting software below. You’re going to want to see this…

KO Still Has Fair Upside Potential and Safety Despite Poor Timing

The VectorVest system helps you simplify your trading strategy, allowing you to enjoy a higher rate of success with less work and less stress. It’s all possible through the proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it.

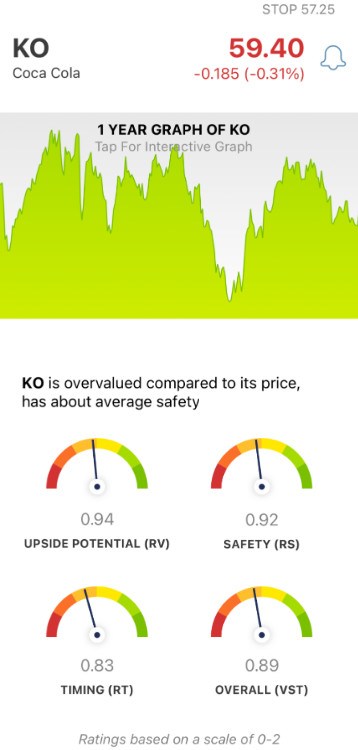

You can rely on just 3 simple ratings to tell you everything you need to know about an opportunity. These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. Just pick stocks above the average and win more trades!

To make things even easier, VectorVest gives you a clear buy, sell, or hold recommendation based on these three ratings - leaving no doubt as to what your next move should be. As for KO, here’s the current situation:

- Fair Upside Potential: The RV rating gives you insights into a stock’s long-term price appreciation potential (3 years out) compared to AAA corporate bond rates and risk. And right now, KO still has fair upside potential with an RV rating of 0.94 - just below the average.

- Fair Safety: In terms of risk, KO is fairly safe - as the RS rating of 0.92 shows. This rating is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The biggest issue for KO right now is the negative price trend that has formed over the past few months - which was strengthened by yesterday’s news about profit concerns. Right now, the RT rating of 0.83 is poor. This is derived from the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 0.89 - which is fair. But what does that mean for you - is it time to sell any shares you have? Or, is now actually a good time to add KO to your portfolio at a discount? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, KO has fair upside potential and safety - but the timing is poor, as a negative price trend has taken hold of this stock.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment