Wednesday morning saw Charles Schwab Corp. (SCHW) drop nearly 4% by 11 AM EST – down to $80/share. This resulted from a dismal earnings report for the fourth quarter.

Charles Schwab, a company engaged in wealth management, brokering, and other financial advisory services, fell short of analyst expectations for both adjusted earnings and revenue.

The company did enjoy an uptick in revenue – up 17% year over year. However, Wall Street was looking for a target revenue of $5.55 billion, which the company missed. The reported revenue was just $5.5 billion. Earnings came in at $1.07 per share while analysts set a target of $1.09 per share.

However, the company did grow profits thanks to higher interest rates boosting their net income – which came in 25% higher than the same period last year. Even this figure, though, was a slight underperformance compared to what analysts were expecting from the firm.

CEO Walt Bettinger considers the quarter a success, though, as most key metrics improved despite growing concerns of a recession, inflation, and other market factors of instability.

However, investors did not react to all this news with the same positive fervor. SCHW stock was climbing steadily until today – up over 18% in the past 3 months. Is today’s drop a sign of more to come for Charles Schwab – or will this be a temporary bump in the road?

If you’re wondering what your next move should be with this stock, keep reading – the Vectorvest stock analysis software will provide you with a clear buy, sell, or hold recommendation.

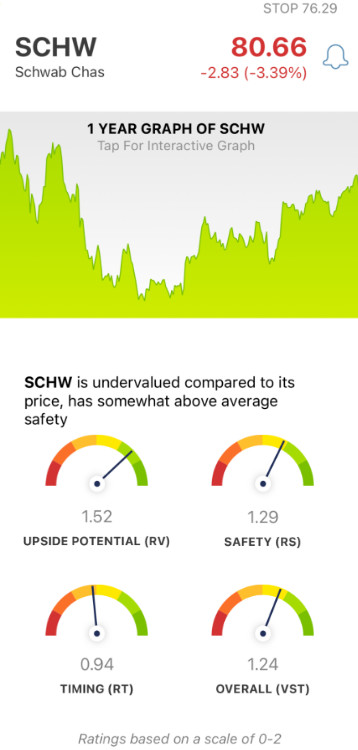

Despite the Hiccup This Morning, SCHW Still Has Excellent Upside Potential & Very Good Safety

The VectorVest system makes uncovering and analyzing opportunities as simple and straightforward as possible - while increasing your chances of success in every play you make. It’s all possible through the proprietary stock rating system, which utilizes just 3 easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings are placed on a scale of 0.00-2.00 - with 1.00 being the average. Ratings above the average indicate overperformance and vice versa. But the best part? Based on these three ratings, VectorVest is able to tell you whether you should buy, sell, or hold any given stock, at any given time. That includes SCHW - which we’ll break down below:

- Excellent Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (projected three years out) compared to AAA corporate bond rates and risk. As for SCHW, the RV rating of 1.52 is excellent. Moreover, the stock is undervalued at the current price of $80.66/share - the current value sits at $106.15.

- Very Good Safety: In terms of risk, SCHW has very good safety - as supported by the RS rating of 1.29. This rating is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: Despite the slight drop in stock price today, SCHW still has fair timing - with an RT rating of 0.94, just below the average. This is derived based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year - giving you the full picture of how a stock is trending.

Taking all three of these ratings into account, VectorVest has provided a good overall VST rating of 1.24. But - does that mean now is the time to buy? If you want a clear answer without any guesswork or emotion factoring into your decision-making, get a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SCHW, it is undervalued with excellent upside potential, very good safety, and fair timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment