Yesterday, Apple (AAPL) gained more than 5% to take shares to as high as $207, crossing the $200 threshold for the first time ever. They’ve picked up where they left off today, up another 5% for more than 11% on the week. The stock is currently sitting at $217/share.

All this comes after the company updated shareholders and the tech world as a whole on its latest innovations during the Apple Worldwide Developer’s Conference, which, you guessed it – consists of AI features.

One of the major takeaways was that this fall we can expect to see a massive upgrade for the iPhone 16 alongside the iOS18 release, and with it, an uptick in sales. This couldn’t have come at a better time as the company’s iPhone sales have fallen to levels we haven’t seen since prior to the pandemic in 2020.

However, the real star of the show was Apple Intelligence – the company’s generative AI offerings which will be rolled out across Siri and messaging. The technology is powered by OpenAI.

What makes this unique is that Apple doesn’t seem interested in developing its own LLM like other tech companies, such as Meta and Google. While this would certainly bring costs down in the long run, we’ve seen these types of investments cost billions without even beginning to deliver a return yet.

Just a few months ago we wrote about how AAPL had been struggling through the first few months of the year but encouraged investors to maintain their positions and weather the storm. That advice paid off for those who listened.

After the past few days’ performances, AAPL is up 25% over a three month span and up more than 16% through the first half of the year thus far. So, is this a good time to buy this stock?

We’ve taken a closer look at this opportunity through the VectorVest stock forecasting software and found 3 reasons you may want to add AAPL to your portfolio or bolster an existing position. Here’s what you need to know…

AAPL Has Fair Upside Potential, Good Safety, and Excellent Timing

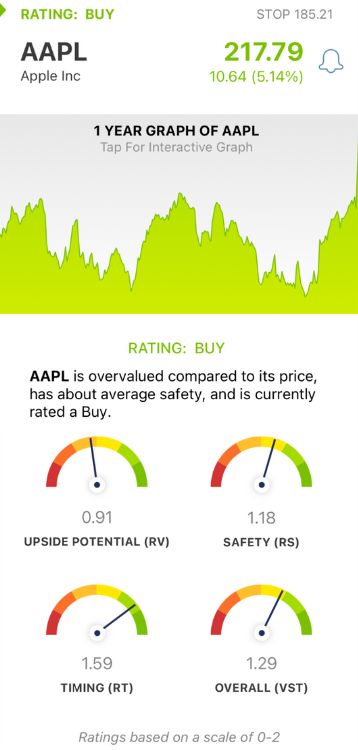

The VectorVest system simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it - all through 3 proprietary ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00, with 1.00 being the average - allowing for quick and easy interpretation compared to traditional stock analysis. But it gets even better. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for AAPL, here’s the current breakdown:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the standard comparison of price to value alone. As for AAPl, the RV rating of 0.91 is below the average but deemed fair nonetheless.

- Good Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.18 is good for AAPL.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. AAPL has an excellent RT rating of 1.59, reflecting the stock’s performance so far this year.

The overall VST rating of 1.29 is very good and enough to earn AAPL a BUY recommendation. But before you make your next move, we encourage you to take a moment to dig deeper with this free stock analysis for even more insights - it’s time to transform your trading strategy for the better to win more trades with less work!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AAPL has gained 11% over the past few days on the heels of its highly anticipated keynote event. Excitement for the new iPhone, the latest iOS, and the announcement of its own AI features has created quite a frenzy. The stock itself has fair upside potential, good safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment