Shares of 3M (MMM) started the week strong with a 5% gain upon news that the company has settled a legal battle with the US Military.

The industrial manufacturing company will pay out $5.5 billion for defective combat earplugs. The case in its entirety represents more than 300,000 separate suits. While 3M claimed the earplugs blocked out loud noises and protected against hearing loss while still allowing softer noises to be heard, that proved false.

And while you may be thinking that $5.5b is a steep hit and wondering why shares would climb on that news, put it into perspective: it was originally estimated that 3M would pay out more than $10b!

The company says the earplugs were manufactured by the now-bankrupt unit Aearo, which filed for Chapter 11 last year in an effort to minimize the liability from these earplugs.

This isn’t the first time 3M has been hit with a lawsuit over earplug problems, either. They paid $9.1 million back in 2018 to the US government when their “earplugs that could loosen while being worn” didn’t work properly as ear protection.

While this particular legal battle should be all wrapped up, 3M investors can’t breathe easy just yet. The company is also dealing with an issue of tainted water in which payments could rise to $12.5 billion after putting PFAs (forever chemicals) into public water sources.

All this said, investors are still surprisingly chipper about MMM after sending shares higher this morning – which has cut into the losses the company has taken on so far this year. Now, the stock is down around 12% in 2023.

So, what does that mean for those currently invested in MMM or considering trading the stock? We’ve taken a look through the VectorVest stock analyzing software and found 3 things that will help you make your next move with complete confidence and clarity.

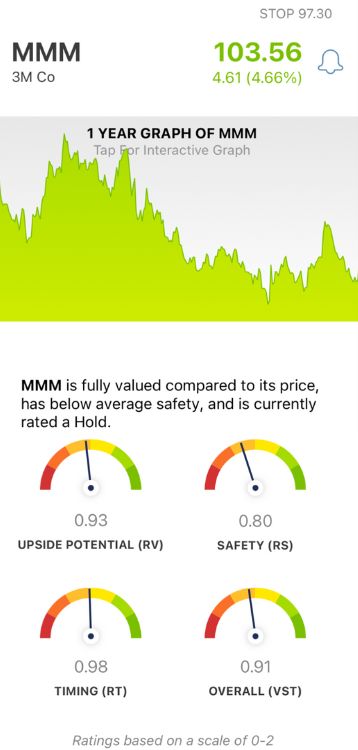

MMM Has Fair Upside Potential and Timing, But Poor Safety

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - simplifying your trading strategy and empowering you to win more trades with less work.

It’s all based on three simple ratings that give you all the insights you need: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average.

Based on these ratings, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time - eliminating guesswork and emotion from your decision-making. That being said, here’s what we’ve uncovered for MMM:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. This offers far superior insights than a simple comparison of price to value alone. As for MMM, the RV rating of 0.93 is fair, albeit a bit below the average.

- Poor Safety: The RS rating is an indicator of risk, and is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. And right now, MMM has poor safety with an RS rating of 0.80.

- Fair Timing: Even though MMM popped this morning, the timing for this stock is still slightly below the average with an RT rating of 0.98 - but is still deemed fair nonetheless. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for MMM of 0.91 is slightly below the average but is still considered fair. That being said, where does that leave you - should you buy, sell, or hold this stock?

A clear answer based on a tried-and-true system is just a click away - get a free stock analysis today at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Although the company is going to have to pay out $5.5 billion, it could have been worse - so investors took the news well. That being said, there’s not much to be excited about as an MMM investor right now. The stock has poor safety with just fair upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment