We’ll shortly be emailing your free stock analysis report.

Note that your email provider may divert your report to a folder other than your inbox.

You have used of free reports for today, and of total available.

In the meantime, watch this video to learn how VectorVest works

Unlock unlimited analyses on 16,000 stocks, along with simple, daily, buy, sell or hold ratings on every stock. Sign up in seconds, cancel anytime.

The VectorVest approach to picking stocks, using our proprietary VST™ ratings.

Successful investing relies on stable, lasting returns, not on chasing big gains from trendy stock picks. Our VST™ (Value-Safety-Timing) ratings stack the odds in your favor by recommending safe, undervalued stocks on the rise—irrespective of their current popularity.

Value

Undervalued Stocks

Undervalued stocks offer lower downside risk and higher probability of achieving gains.

Safety

Safe Stocks

Safe stocks have track records of steady earnings performance. There is less risk in holding stocks of financially stable companies.

Timing

Stocks Rising in Price

Really good stocks usually take off and don’t look back. A stock rising in price is already doing what you want it to do.

How to use VST™ ratings to grow your portfolio in as little as 10 minutes a day.

Our exclusive VST™ ratings distill hundreds of data points into clear buy, sell, or hold recommendations for every stock. This makes trading impossibly simple, ideal if you’re new to investing or learning to manage your own portfolio.

- 1

Check for stocks rated a sell (more than likely your stops will get you out before this happens).

- 2

Check the market timing signal to see if you should buy stocks or tighten stops on existing positions.

- 3

If the market timing is favorable, pick stocks with the highest VST rating.

- 4

Set recommended stop prices, calculated uniquely for each stock based on its historical price movement.

If you’re a seasoned investor, or developing your skills: VectorVest offers limitless opportunities for learning, growth, and portfolio management through deep data, insights, and educational resources.

VectorVest is a simple source for market guidance

that helps you make money in the stock market.

VectorVest is the only stock analysis and portfolio management system that analyzes, ranks and graphs over 16,000 stocks each day for value, safety and timing and gives a clear buy, sell or hold rating on every stock every day.

VectorVest gives you ANSWERS, not just data. What to buy. What to sell. Most importantly, WHEN. Unbiased, independent answers. Investment guidance provided at a glance or through your own analysis.

How can something so complicated be that simple?

For over 40 years, VectorVest has been creating mathematical models to clearly define EXACTLY what causes a stock’s price to rise or fall. No opinions or guesswork. Just math.

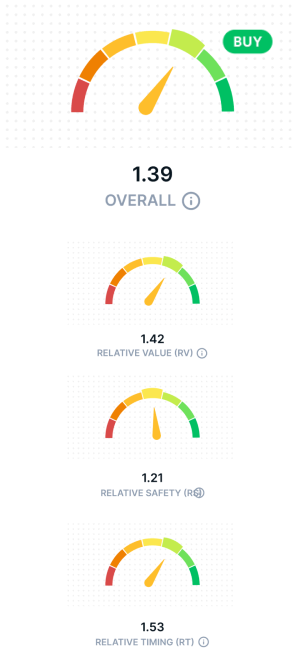

It can all be summed up in three mathematical models: value, safety and timing (VST). VectorVest rates Value, Safety and Timing the same: it starts at 1.00, and ranges from 0.00 To 2.00.

READ MORE

Take Relative Value (RV): Anything above 1.00 is worth looking at. Anything below 1.00 is a red flag. Stocks with ratings higher than 1.00 have above average appreciation potential. If it were below average, you’d be better off in AAA corporate bonds.

Relative Safety (RS): Tells you how stable a stock is compared to other investments. Again, if the stock is above 1.00, it’s safer and more predictable than other stocks. If it’s risky and unpredictable, the rating will be below 1.00.

Finally, Relative Timing (RT): How does the short-term price performance look? Above 1.00 is good, below 1.00 is risky, and if the price trend is flat, it just gets a 1.00.

The result is a system for stock market trend analysis using value, safety and timing (VST) to create clear BUY, SELL and HOLD signals that direct investors to rising stocks, in rising sectors and markets. No guesswork. No gut feelings.

Deciding is simple. Choose the stock with the highest VST.

Discover World-Class

Stock Analysis & Market Guidance

VectorVest tells you when to buy, what to buy,

and when to sell. It’s that simple.

- What stocks should you buy?

- Is now a good time to buy?

- When should you consider taking profits?

Direct & definitive answers at a glance or through your own analysis of VectorVest’s powerful database and charting tools.

100% satisfaction guarantee or your money back.

What Subscribers are Saying

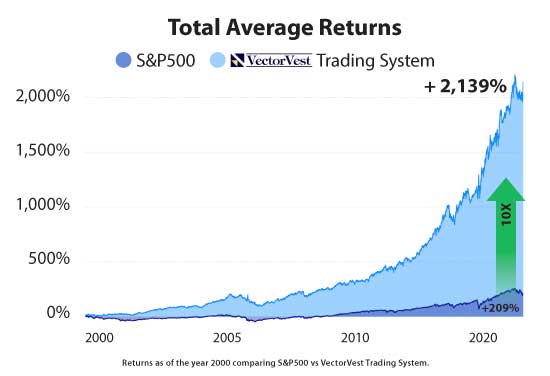

Bull & Bear Market Beating Returns

VectorVest has outperformed

the S&P 500 by 10x over 22 years!

How have we accomplished such an impressive feat? Simple. While others are buying and holding, we believe different markets require different investment strategies. During bull runs we recommend stocks with consistent and predictable earnings growth. During bear markets we advocate moving to cash or taking short positions.

Best part is we tell you when and how to do it all!

It’s easier than you think.

VectorVest is the only service that gives you information going back to 1995, so you can test and verify its amazing performance.